Mumbai3 minutes ago

- Copy link

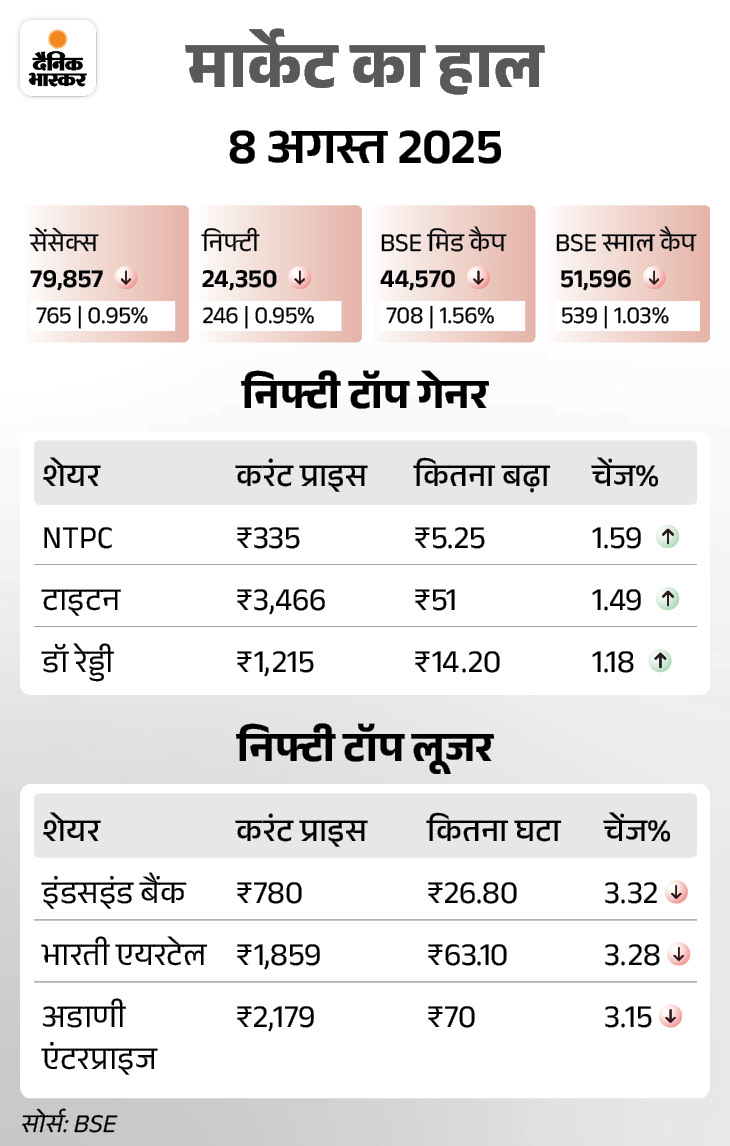

The Sensex fell 765 points to close at 79,857 on Friday, August 8, the last trading day of the week.

The date of August 12 is important for the stock market. According to Harshubh Shah, director of wealth analytics, traders should remain alert on this day. A large Momentum may be seen in the market.

Apart from this, in the week starting from July 11, inflation data, Trump-Putin meeting to the purchase and sale of foreign investors and technical factors will decide the market moves.

Let us understand what can happen in the market this week…

Support Zone: 24,331 / 24,143 / 23,875 / 23,320 / 22,868

Support means the level where the share or index falls from falling down. The price does not go down easily due to increasing shopping here. You can get a chance to shop at these levels.

Resistance Zone: 24,380 / 24,450 / 24,540 / 24,650 / 24,808 / 24,850

Resistance, ie, the level where the stock or index is hindered. This happens due to increasing selling. If the Nifty Registration crosses the zone, a new fast may occur.

Important date for stock market

Wealth Analytics has highlighted the date of August 12 in its weekly report. According to the report, a large movement can come on the 12th (± 1 day). It can surprise both Momentum Bears and Bulls. If you are trading, be alert on this day. Momentum may suddenly change.

A sharp decline was seen on the date of August 8

Harshubh Shah, director of wealth analytics, had said in the previous report that a big movement could be seen on August 8 and exactly the same. On these days, the Nifty declined by 232 points. At the same time, on August 7, a vaolate was highlighted as a day in this report. On this day there was a sharp intraday fluctuations.

Now 5 factors who can decide the direction of the market…

1. Inflation figures: Retail inflation figures will be released on August 12 and wholesale inflation figures will be released on August 14. It is expected that inflation rate may decrease further in July.

Retail inflation had come down to 2.10% in June. It was a low of 77 months. Retail inflation had declined due to continuous softening in the prices of food items. At the same time, wholesale inflation had come down to 0.13% in the month of June. This was its 20 -month low.

2. Trump-Putin Meet: The US President and his Russian counterpart Vladimir Putin will meet in Alaska on Friday, August 15. This meeting will be in the eyes of the whole world, as this may open the way to end the Russia-Ukraine war. The war has been going on since the attack on Ukraine in Russia on 24 February 2022.

3. Foreign Investors: In the cash segment, FPI sold shares worth Rs 47,666.68 crore in July and so far in August they have sold shares worth Rs 14,018.87 crore.

However, on Friday, August 8, he bought shares worth Rs 1,932.81 crore in the cash segment. It is too early to say that this trend of FPI shopping will remain, as the short-term outlook of the market remains blurred due to tariff’s uncertainty and weak corporate earnings.

If FPI continues to purchase Indian shares like August 8, it will support the domestic market and perhaps the benchmark index can get out of its range from June.

4. Results of companies: Investors will also monitor the earnings of some major companies this week. According to BSE, more than 2,000 companies will declare their June quarter results in the coming week. These include Bajaj Consumer Care, Ashok Leyland, ONGC, IOC, Hindalco Industries, BPCL, and Hindustan Copper.

5. Technical Factors: According to Sudeep Shah, head of technical and derivatives research in SBI Securities, the zone of 24,200-24,150 will work as a significant support for the index.

This zone is special because it is a 200-day EMA level and previous upward rally (21,743-25,669) 38.2% Fibonacci Retress Point. If the index slips below 24,150, it can go down to 23,750. At the same time, upwards 24,570-24,600 will have a major obstruction for 100-day EMA zone index.

Sensex came down to 80 thousand after 4 months

The Sensex fell 765 points to close at 79,857 on Friday, August 8, the last trading day of the week. After 4 months, it has come below 80 thousand. Earlier on May 9, the market came to 79,454. The Nifty also fell by 246 points, it closed at 24,350. Of the 30 shares of the Sensex, there was a rise in 5 and a decline in 25. Metal, IT, Auto and Realty sector shares declined significantly.

Disclaimer: This article is only for information and learning. The above opinion and advice are of individual analysts or broking companies, not Dainik Bhaskar. We advise investors to consult certified experts before taking any investment decision.