- Hindi news

- Business

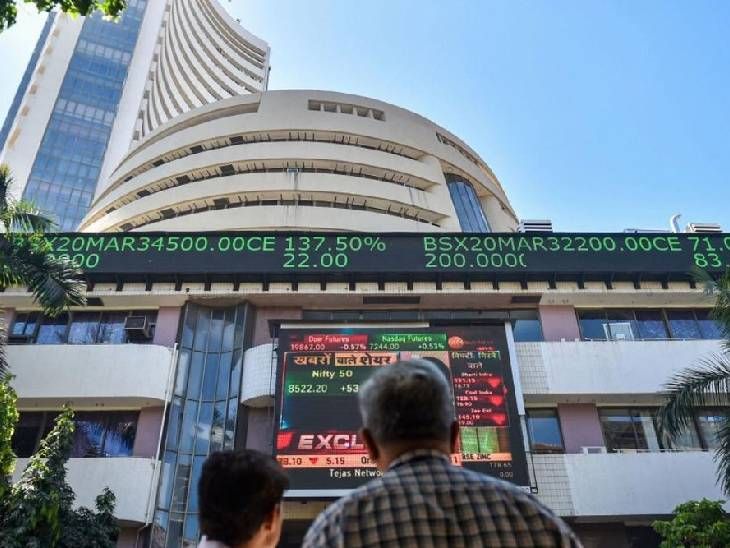

- 5 Important Lessons for Retail Investors to Navigate Market Volativity Safe

Mumbai2 days ago

- Copy link

SEBI has accused this American trading company of manipulation of Rs 4,843.57 crore in the market.

The Jane Street Group case in the Indian stock market has highlighted a major scam. SEBI has accused this American trading company of manipulation of Rs 4,843.57 crore in the market. This has caused huge losses to small investors from the scam. Here, understand 5 important lessons for retail investors in question and answer …

Question 1: How do big investors affect the market, what should retail investors do?

answer: Large traders, such as Jane Street, can affect the market index (such as Nifty, Bank Nifty) by buying and selling huge amounts. Especially on the day of options expiry, they can bring a sharp bounce or decline in the market with their strategies, which do not reflect the real market sentiments.

How does it work,

Large funds and foreign institutional investors (FII) can up and down the index on the basis of their big volumes. For example, Jane Street increased the index by making heavy purchases in the morning and then made profits by taking short positions in options.

Caution,

- Do not trade in a hurry after seeing a sudden rise or decline in the market.

- Only rely on the advice of SEBI-registered broker or advisors.

- Small investors should fix their investment risk and pay attention to long -term investment to avoid the manipulation of big players.

Question 2: Why is trading risky by looking at the index movement?

answer: Trading can be dangerous by seeing a sudden rise or decline in Nifty or bank Nifty, as this movement can be the result of big investors strategy or market rumors.

How does it work?

Large traders can manipulate the index for their benefit. For example, Jane Street used the “Marking the Close” strategy, affecting the closing price of the index by making large deals in the last hour of trading.

Caution,

- Always check technical indicators such as RSI (Relative Strength Index), MACD, or volume data.

- See Open Interest (OI) data, which explains how many contracts are open and what is the market trend.

- Do not trust social media or unconfirmed news. Make a strategy for your investment and follow it regularly.

Question 3: Why should retail investors be careful on Options Expiry Day?

answer: Options Expiry Day (when the term of options contracts ends) is the most risky, as large investors can manipulate the index on this day according to their position.

How does it work?

On expiry Day, big traders can take and move the index up or down, causing a sudden heavy change in the premium of the options. According to SEBI, Jane Street made an illegal profit of Rs 4,843 crore from such strategies.

Caution,

- If you are new to options trading, avoid trading on expiry day.

- If it is necessary to trade, then put very little capital and use strict stop loss.

- Only experienced traders trade with a small position on expiry day, and that too after complete research.

- To understand market volatility, see the VIX (Voltyness Index) data available on the NSE website.

Question 4: How to use SEBI advisory and warnings?

answer: SEBI periodically warns investors about scams, unauthorized advisors and risks. Investors can be safe by following them.

How does it work?

SEBI’s website (www.sebi.gov.in) (www.sebi.gov.in) has a list of guidelines, warnings and registered brokers available for investors.

Caution,

- Go regularly to SEBI’s website and read the latest notice.

- If you see any fraud, then file a complaint on SEBI SCORESS SYSTEM website,

- Only work with SEBI-registered broker (eg zerodha, upstox) and advisors. Check their registration number.

- Do not rely on tips coming from fake calls or telegram/WhatsApp groups.

5. Question: How to avoid greed?

answer: Greed for early profits or FOMO (Fear of Missing Out) may encourage retail investors to take wrong decisions, causing damage.

How does it work?

Investors dream of quickly becoming rich through finfluesrs or unconfirmed tips on social media. Cases such as Gen Street show that the market is very high, and uncomplicated trading can be harmful.

Caution:

- Every day there will be a chance in the market, so do not make big bets in a hurry.

- Always set a stop loss, so that the loss is limited.

- Invest according to your risk capacity. For example, apply only 5–10% of your monthly income in trading.

- Avoid claims like “100% Return” on social media. Always do research.

Read this news too

American firm used to climb the market: Sebi banned, made an illegal earning of ₹ 4,844 crore; Loss to common investors

SEBI has banned the American trading firm Jane Street Group and 3 companies related to it. The American trading firm has been accused of rigging prices on the day of index expiry. SEBI has also ordered to seize illegal earnings of Rs 4,843.57 crore. Read full news …