Mumbai34 minutes ago

- Copy link

The 1995 JP Associates worked in sectors such as Real Estate, Cement, Power, Hospitality and Infrastructure.

The Adani Group has made the biggest bid to buy Jayaprakash Associates. After this news came to light, today JP Power’s stock is more than 15%. At the same time, JP Associates shares have an upper circuit of 5%.

Jayaprakash Associates was once counted among India’s large infrastructure and real estate companies. But today this company is caught in the bankrupt process under the burden of heavy debt. Come, let us understand this whole matter through question and answer…

Question 1: What does JP Associates do and how got caught in trouble?

answer: The 1995 JP Associates worked in sectors such as Real Estate, Cement, Power, Hospitality and Infrastructure. Cities like Delhi-Noida had big projects like JP Vishtown. But to increase its business, the company took a huge debt from banks and financial institutions.

The matter deteriorated when the company failed to pay interest and installments of these loans. Delay in projects, recession in the market, and some management mistakes also became the reason for this.

Finally, on 3 June 2024, the Allahabad bench of the National Company Law Tribunal (NCLT) sent the company into the bankrupt process.

In February 2025, the company had a loan of ₹ 55,493.43 crore. In 2007, the company’s share price was close to 300 rupees. Today it is trading around 3 rupees.

JP Vishtown Project is one of the largest real estate projects in India near Yamuna Expressway in Noida-Greater Noida. It started in 2008-09, but it has not been completed yet.

Question 2: What is this insolvency process?

answer: In easy language, when a company cannot repay its debt, it is declared bankrupt. After this, a process begins under the Insolvency and Bankruptcy Code (IBC), in which the company is either tried to save or selling its assets and returned their money to the lenders.

The same happened in the case of JP Associates. Many companies bid to save the company, so that it could be purchased and brought back on track.

Question 3: Who else are there in the race to buy JP Associates?

answer: Adani Group is at the forefront of this race. According to reports, Adani has bid for Rs 12,500 crore, out of which he has also promised an advance payment of Rs 8,000 crore. The Adani Group feels that JP’s cement, real estate and power sector projects can further strengthen their business.

Especially in areas like Noida, Adani can take great advantage by completing the incomplete projects of JP. Apart from Adani Group, many more big companies were also in this race. These include Anil Aggarwal’s Vedanta, Dalmia Bharat Cement, Jindal Power, and PNC Infratech.

Question 4: What will happen to JP’s debt?

answer: There is a debt of about ₹ 55 thousand crore on JP Associates. If the Adani Group buys it for ₹ 12,500 crore, lenders may have to suffer heavy losses.

Question 5: What will be the effect on the common people?

answer: Many real estate projects of JP Associates, especially in Noida, are incomplete. Thousands of people, who invested money in JP’s flats, are waiting for possession.

If the Adani Group buys the company, it is expected that it will complete these projects, which can provide relief to the homebeelers.

Question 6: What is the condition of JP’s shares?

answer: Talking about the shares of JP Associates, their condition has been very bad. JP Associates shares are still trading restricted, that is, their purchase and sale are banned. Its price is around 3 rupees.

On the other hand, the shares of Jayaprakash Power Ventures, the second company of Jaypee Group, have increased by more than 15% on July 7. It is trading beyond 22 rupees. It has gained more than 25% in the last one month. Its market cap has reached 15 thousand crore rupees.

Question 7: What will happen next?

answer: Right now the bankruptcy process of JP Associates is going on. All the dialects were evaluated in a meeting held on 1 July 2025, with Adani’s strongest.

Now the final decision will be taken soon. If the Adani Group buys it, it will run JP’s business in its own way. Also, stocks like JP Power will also be monitored in the stock market, as investors’ interest is increasing.

-

Invest in Senior Citizens Savings Scheme after retirement: Earning up to Rs 20,500 every month, understand its complete mathematics

- Copy link

share

-

Today the price of gold and silver declines: Gold reduced to ₹ 284 to ₹ 96,737 per 10 grams, silver is being sold ₹ 1.07 lakh kg

- Copy link

share

-

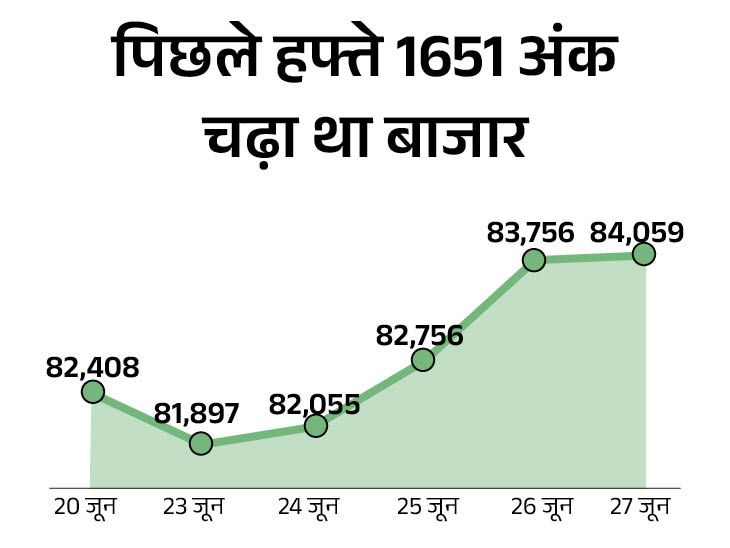

Sensex falls 100 points to trading at 83,350: Nifty 50 points slip; IT, metal, pharma, banking and realty shares fell

- Copy link

share

-

Travel food services IPO opened from today: You will be able to bid by 9 July, minimum will have to invest ₹ 14,300

- Copy link

share