New Delhi3 minutes ago

- Copy link

Sanjay Malhotra, Governor, Reserve Bank of India (File Photo)

Got relief from inflation. Retail inflation was just 2.1% in June. Now the loan installments can also decrease further. The repo rate may be reduced again in the meeting to be held in the Reserve Bank of August.

RBI Governor Sanjay Malhotra said that the neutral attitude does not mean that policy rates cannot be reduced. It can be further cut when needed.

In June itself, the repo rate has been reduced from 0.5% to 5.50%. Since February, it has been cut by 1%. Banks fix loan rates according to this rate.

The August meeting will have two -way analysis on interest rates. Not only inflation in future, but also on the economic growth of the country will be considered. The rates can be reduced if GDP data is seen lethargy. Sanjay Malhotra, Governor, Reserve Bank of India

When the repo rate decreases, banks get cheaper debt

The rate at which the Reserve Bank of India i.e. RBI gives loan to banks is called repo rate. When RBI reduces the repo rate, banks get cheaper debt, and they bring this advantage to the customers. That is, loans like home and auto will become cheap by 0.50% in the coming days.

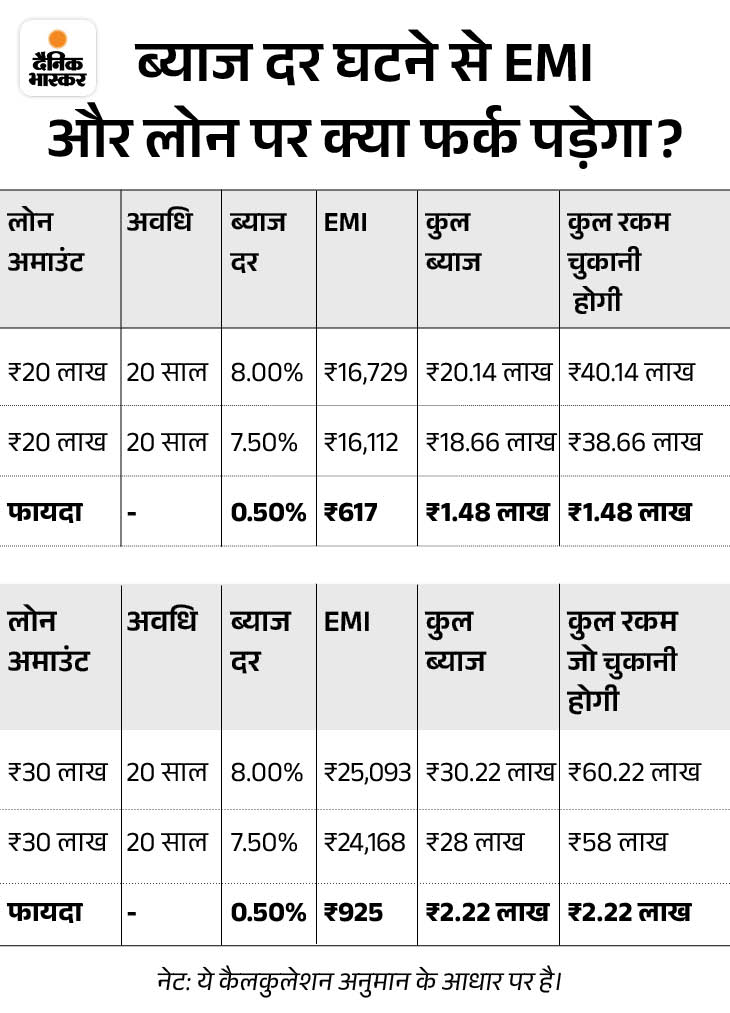

After the latest cuts, EMI will decrease to Rs 617 on a loan of ₹ 20 lakhs of 20 years. Similarly, EMI will be reduced by Rs 925 on a loan of ₹ 30 lakh. Both new and existing customers will benefit from this. There will be a benefit of about 1.48 lakhs in 20 years.

Inflation below the estimate of the Reserve Bank

- The central bank had estimated retail inflation to be 3.7% on an average in 2025-26. But in June it came close to 2%.

- The average retail inflation in April-June has come down to 2.7%. This is also less. The RBI had an idea that inflation would be 2.9% during this period.

Retail inflation can remain only 1% in July

- The American brokerage company City said that the situation is such that retail inflation in India could come to a record low of 1.1% in July.

- According to the city, the average inflation rate can be reduced to 3.2% in FY 2025-26, starting from April 1. This will be the lowest retail inflation rate since 1990.

Interest rates and need to reduce these reasons …

- Car sales in June came to a low -lying level.

- The sale of houses in the top-7 cities in April-June declined by 20%. If the rates decrease, the situation can turn.

- The export of gems and jewelery declined by 14.25% in June. The imports of diamonds have also declined by more than 7%. That is, demand is low.

Repo rate reduced by 3 times this year, 1% cut

The RBI had reduced the interest rates from 6.5% to 6.25% at the meeting held in February. This deduction was done by the Monetary Policy Committee after about 5 years.

The interest rate was reduced by 0.25% in the meeting held in April for the second time. Now the rates have been cut for the third time. That is, the Monetary Policy Committee has reduced interest rates by 1% at three times.

Housing demand will increase due to decrease in repo rate

After decreasing the repo rate, banks also reduce interest rates on loans like housing and auto. Housing demand will increase when interest rates are reduced. More people will be able to invest in real estate. This will boost the real estate sector.

₹ 2.5 lakh crore will come in financial systems due to reduced CRR

RBI Governor Sanjay Malhotra said that it has been decided to reduce it from 4.00% to 3.00% by cutting 1% in cash reserve ratio (CRR). He said that this move of RBI will bring ₹ 2.5 lakh crore in financial system.

CRR is the money that banks have to keep a part of their total deposits with the Reserve Bank of India (RBI). With this, RBI controls how much money will be in the market. If CRR is low, banks have more money left to give loans, such as 1% cut will bring ₹ 2.5 lakh crore in the system.