- Hindi news

- Business

- Imf said, India tops global fast payments rankings, upi leads the charge

New Delhi13 minutes ago

- Copy link

85% of the digital payments in India are being made through UPI, of which 49.1 crore users, 6.5 crore businessmen and 675 banks are connected on the same platform.

India has secured the first position in the world in the fast and secure digital payment sector. According to the recent report by the International Monetary Fund (IMF), India has achieved this position in digital transactions due to Unified Payments Interface (UPI).

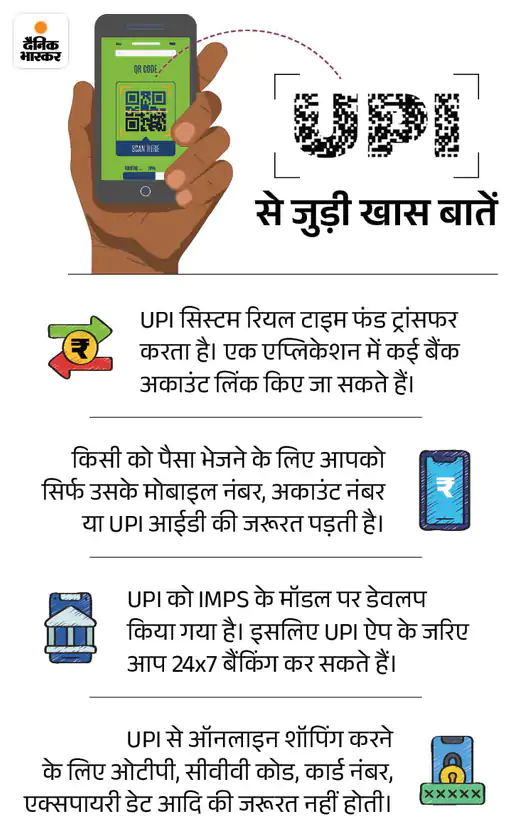

The UPI, launched by the National Payments Corporation of India (NPCI) in 2016, has become the easiest and popular way of money transactions in the country today. With the help of UPI, people can connect many bank accounts with the same mobile app and can do safe, low -cost transactions in a few seconds.

UPI has more than 1800 crore transactions every month

According to the Press Information Bureau (PIB), UPI has more than 18 billion transactions or 1800 crore transactions every month. In June 2024, UPI did a turnover of Rs 24.03 lakh crore with 18.39 billion or 1839 crore transactions, which shows a growth of 32% compared to 13.88 billion transactions (1388 crore) in June 2023 last year.

UPI extends India towards digital-dominated economy

PIB said, “UPI has taken India away from cash and card based payment and extended towards a digital-dominated economy.” This platform has become a strong means of financial increases not only for big business, but also for small shopkeepers and common people.

85% digital payment in India is being made through UPI

Today 85% of the digital payments in India are being made through UPI, of which 49.1 crore users, 6.5 crore businessmen and 675 banks are connected on the same platform. Not only this, UPI is now handling about 50% real-time digital payments at global level.

UPI is also being used outside India

The impact of UPI is now visible outside India’s borders. It is also available in seven countries- United Arab Emirates, Singapore, Bhutan, Nepal, Sri Lanka, France and Mauritius. The start of UPI in France is a symbol of its first step in Europe, making it easier for Indians living abroad or traveling abroad.

PIB said, “It is not just a matter of data, but it shows the growing trust on India’s digital framework and rapid steps towards a cashless economy.” The UPI has not only made the transaction easier, but has also connected small traders and people living in rural areas to digital economy. This success of UPI is establishing India as a global leader in technological innovation and financial increases.