MumbaiA few moments ago

- Copy link

On July 18, the Sensex fell 502 points to close at 81,758 at the last trading day of the week. The Nifty fell by 143 points, it closed at 24,968 levels.

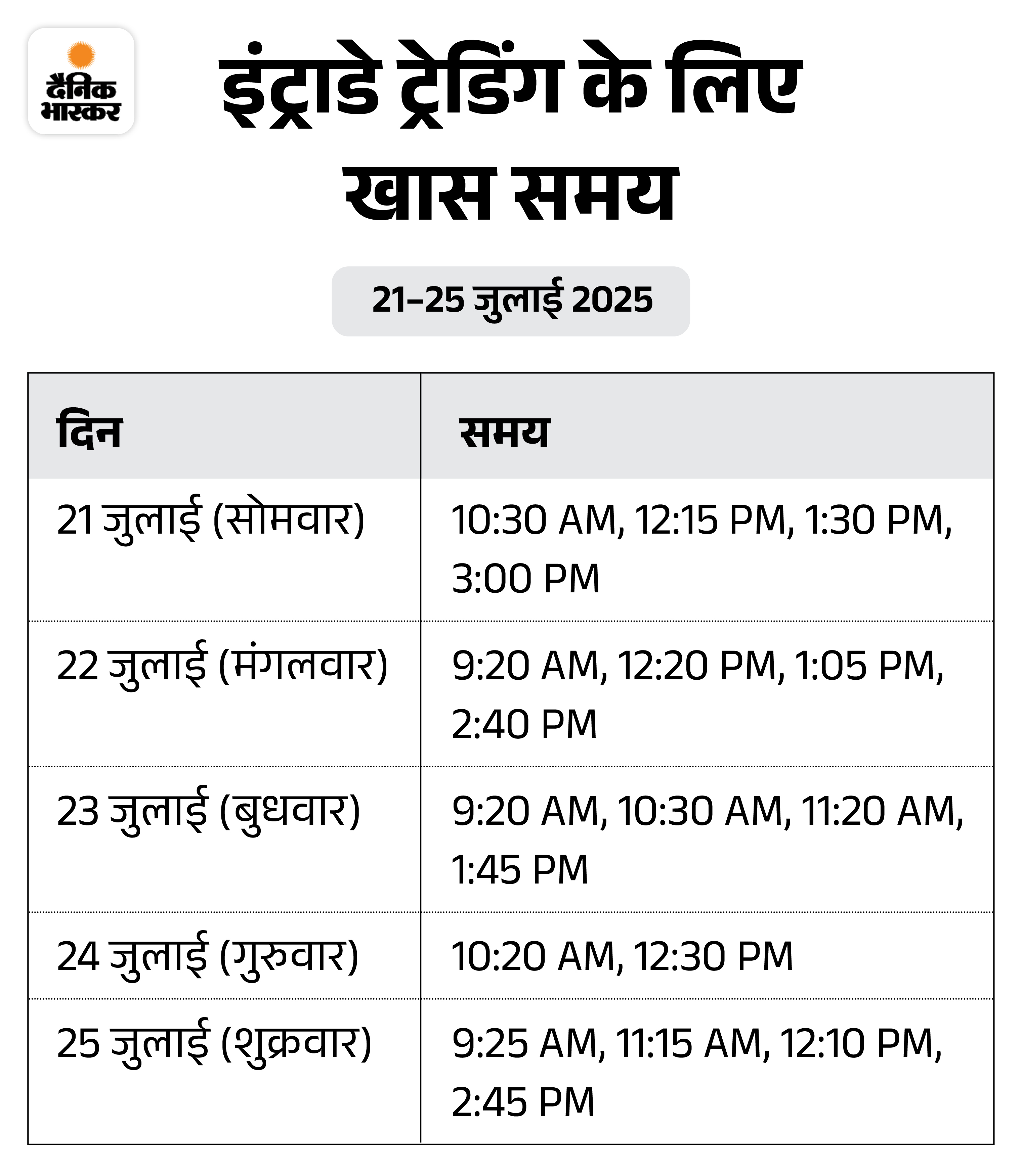

The week of 21 to 25 July 2025 for the stock market can be quite ups and downs. According to Harshubh Shah, director of wealth analytics- a sharp Intrade movement can appear on July 22-23. At the same time, 24-25 July is special for Physical Traders.

Apart from this, Indo-US trade deal, the result of the first quarter companies, the purchase and sale of foreign investors and technical factors will decide the market moves.

Let us understand what can happen in the market this week…

Important level of Nifty this week

Support Zone: 24,978 / 24,850 / 24,676 / 24,538 / 24,450

Support means the level where the share or index falls from falling down. The price does not go down easily due to increasing shopping here. You can get a chance to shop at these levels.

Resistance Zone: 25,080 / 25,147 / 25,320 / 25,434 / 25,566 / 25,600

Resistance, ie, the level where the stock or index is hindered. This happens due to increasing selling. If the Nifty Registration crosses the zone, a new fast may occur.

Two important dates for the stock market

- 22-23 July: Expect a sharp intraday movement in the market. Great opportunity for short-term and scalping trades.

- 24-25 July: Important time for positional traders, as the market can become top or bottom.

Last week review: 15-19 July

Harshubh Shah said- In our previous report, we had described July 15 an important day and indeed this day was very important for the market. On July 19, when the low level of July 15 was broken, the Nifty showed a sharp decline. The high level of July 15 was also special- On July 16, the market tried to break this level. This was followed by more selling.

Now 5 factors who can decide the direction of the market…

1. Results of companies: This week 286 companies will declare the results of the June quarter. Among the companies included in the Nifty, Eicher Motors, UltraTech Cement, Bajaj Finance, Bajaj Finserv, Dr. Reddy’s, Infosys, Tata Consumer Products, Nestle India, SBI Life Insurance, Cipla and Kotak Mahindra Bank are to be held.

In addition, some more popular companies such as One 97 Communications (Paytm), Indian Railway Finance Corporation, United Bruriaries, G Entertainment and Bajaj Housing Finance will also release their results.

After the market closure on Friday, the impact of the results of Reliance Industries and JSW Steel will also be seen on the market this week. Also, due to the results of HDFC Bank, ICICI Bank, Yes Bank and Reliance Power on Saturday, all these shares will be monitored on the opening of the market on Monday.

2. India-America Trade Deal: India and the United States have completed the fifth round of talks for the proposed Bilateral Trade Agreement (BTA) in Washington. The four -day discussion, which lasted from 14 to 17 July, was led by Rajesh Aggarwal, Chief of India and Special Secretary of the Ministry of Commerce.

This period is special because the two countries are trying to finalize an interim trade deal before 1 August. This date is important because the suspension period of Trump-era tariffs is ending on this day, which imposed additional duty of up to 26% on imports of many countries including India.

3. Foreign and Domestic Investors: In the coming week, the direction of the market will depend largely on the attitude of foreign institutional investors (FII). On Friday, FII bought shares worth Rs 374.74 crore, that is, they were net buyers. At the same time, domestic institutional investors (DII) were also net buyers and they purchased Rs 2,103.51 crore.

4. Technical Factors: Asit C. Mehta Investment Intermediate AVP (Technical and Derivative Research) Hrishikesh Yedve said that the Nifty has broken its 34-day experiencedly moving averages (34-dima) on the daily chart and created a red candle, which is a sign of weakness.

However, the Nifty rests above the 50-DEMA, which is currently around 24,930. If this level breaks, the Nifty can go down to a range of 24,750-24,500. On the other hand, if the Nifty rests above 24,930, then a recovery of 25,200-25,250 can be expected.

According to Ajit Mishra, SVP (Research) of Railways Broking Limited, the market index may remain in the range with little pressure in the near future due to weak quarterly results and global uncertainties.

He said, “The Nifty closed below the important psychological level of 25,000 last week, indicating vigilance. If the Nifty breaks the support level of 24,900, it is expected to fall further. It can go up to a range of 24,450-24,700 in the coming sessions.

On the upper side, 20-day EMA is currently working as short-term interruption. This can prevent recovery around 25,250. For speed, it is necessary to cross this level firmly. Until this happens, the market is expected to remain under trend pressure. “

5. Economic Statistics: On the economic front, investors will have a special eye on India’s infrastructure output and HSBC flash PMI figures (manufacturing, services and composite sector).

Four new iPO will open for subscription in the mainboard segment

The Indicube Spaces issue will open on Wednesday, 23 July. The IPO of GNG Electronics will also be launched on the same day. The IPO of Brigade Hotel Ventures will open on July 24. Shanti Gold International’s IPO will open on 25 July.

The market closed after falling 502 points on Friday

On July 18, the Sensex fell 502 points to close at 81,758 at the last trading day of the week. The Nifty fell by 143 points, it closed at 24,968 levels.

Out of 30 Sensex’s 30 shares, 23 declined and 7 declined. Axis Bank shares closed down 5.25%. BEL, Kotak Bank and HDFC Bank shares also declined 2.5%. At the same time, Bajaj Finance and Tata Steel shares climbed up to 2%.

Disclaimer: This article is only for information and learning. The above opinion and advice are of individual analysts or broking companies, not Dainik Bhaskar. We advise investors to consult certified experts before taking any investment decision.