Mumbai4 minutes ago

- Copy link

The minimum lot of minimum for investment is of 18 shares. For which Rs 14,400 (Rs 800 x 18) is needed.

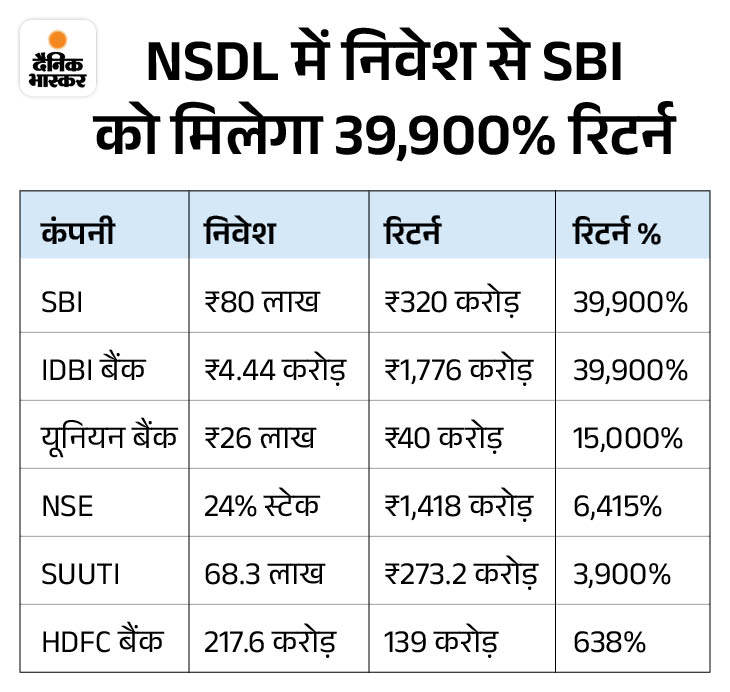

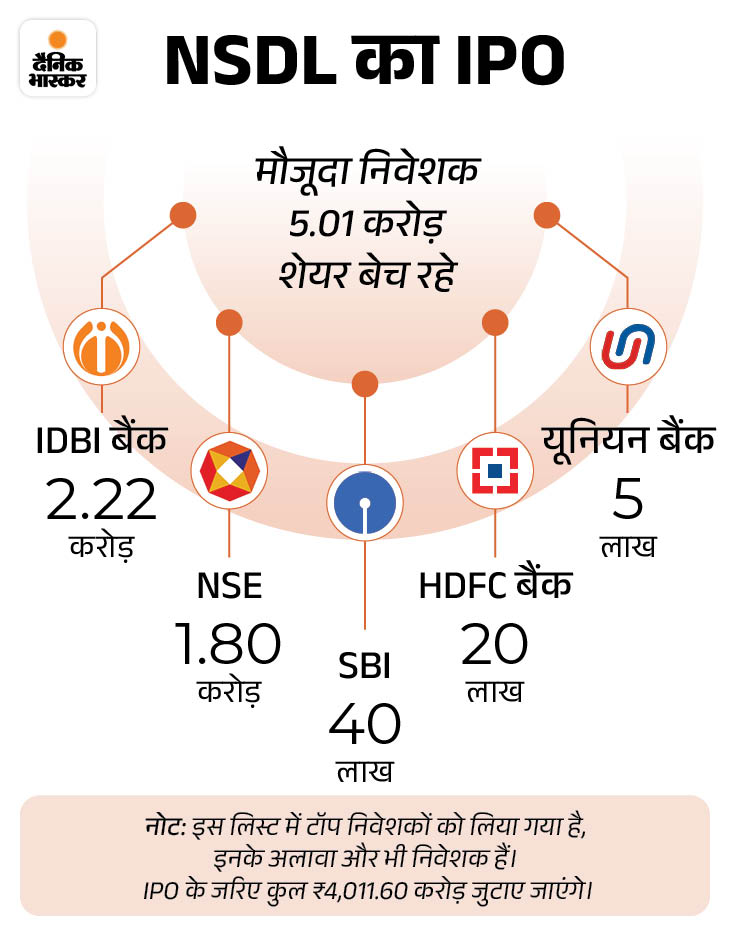

The upcoming IPO of India’s largest depository NSDL is going to prove to be a machine to make money for its investors. The company’s institutional investors such as SBI, IDBI Bank, NSE, HDFC Bank and others are going to get a return of up to 39,900% on their original investment.

Investors bought NSDL shares for Rs 2, which has now become Rs 800. NSDL has fixed a price band of Rs 760 to 800 per share for its IPO. Its shares in unlisted market are currently trading at Rs 1,025.

IPO will open on July 30

NSDL’s IPO will open on 30 July 2025 and will close on 1 August 2025. The IPO bidding for anchor investors will begin a day before i.e. on 29 July.

- Minimum lot: 18 shares, for which Rs 14,400 (Rs 800 x 18) is required.

- Retail Investors: At most 13 lots (234 shares) can be applied.

- For employees: 85,000 shares reserve, which will get a discount of Rs 76 per share.

Share price 22% less than unlisted market

NSDL has kept the share price of Rs 760-800, which is 22% less than the price of ₹ 1,025 running in the unlisted market. In the unlisted market, its shares were first on peak of ₹ 1,275.

This has also been seen before. Companies like Tata Technology, HDB Financial Services and PB Fintech also kept their IPO priced lower than the unlisted market. The advantage of this is that during the listing, there can be a good jump in the stock.

How is the company’s financial health?

Company in financial year 2024-25 (FY25):

- Net Profit: Rs 343.12 crore, which is 24.57% more than 275.45 crores in the previous year.

- Revenue: Rs 1,535.19 crore, which is 12.41% more than 1,365.71 crore of FY24.

- Market Cap: The market cap will be around Rs 16,000 crore at an upper price of Rs 800.

The company’s price-to-aranings (P/e) ratio is 46.62, which is less than 66.63 P/E of its competition Central Depository Services Limited (CDSL).

Should I invest in IPO?

NSDL’s IPO can be a good chance for investors who want to invest for a long time. The company’s business model is strong, as it is an important part of India’s growing stock market. Also, its valuation is cheaper than CDSL.

A good premium is also seen in the unlisted market. However, before investing, take advice from your financial advisor and keep an eye on the market status.

Keep in mind 2 things before investing…

- Market instability: There is ups and downs in the primary market, listing may be affected.

- Gray Market Risk: Do not rely fully on GMP, as it is unofficial.

How to apply?

You can apply in NSDL IPO through online UPI or ASBA. For this, use platforms like Zerodha, Upstox, HDFC Bank or SBI Bank.

The allotment of the IPO will be finalized on 4 August 2025 and the stock will be listed on the Bombay Stock Exchange and National Stock Exchange on 6 August 2025.

What is NSDL and its work?

NSDL is a depository institution. That is, it works to keep shares, bonds and other securities in digital form in your demat account.

Just as the bank keeps your money safe, NSDL keeps shares safe in demat account. This company, formed in 1996, is today the largest depository in the country.