Mumbai3 minutes ago

- Copy link

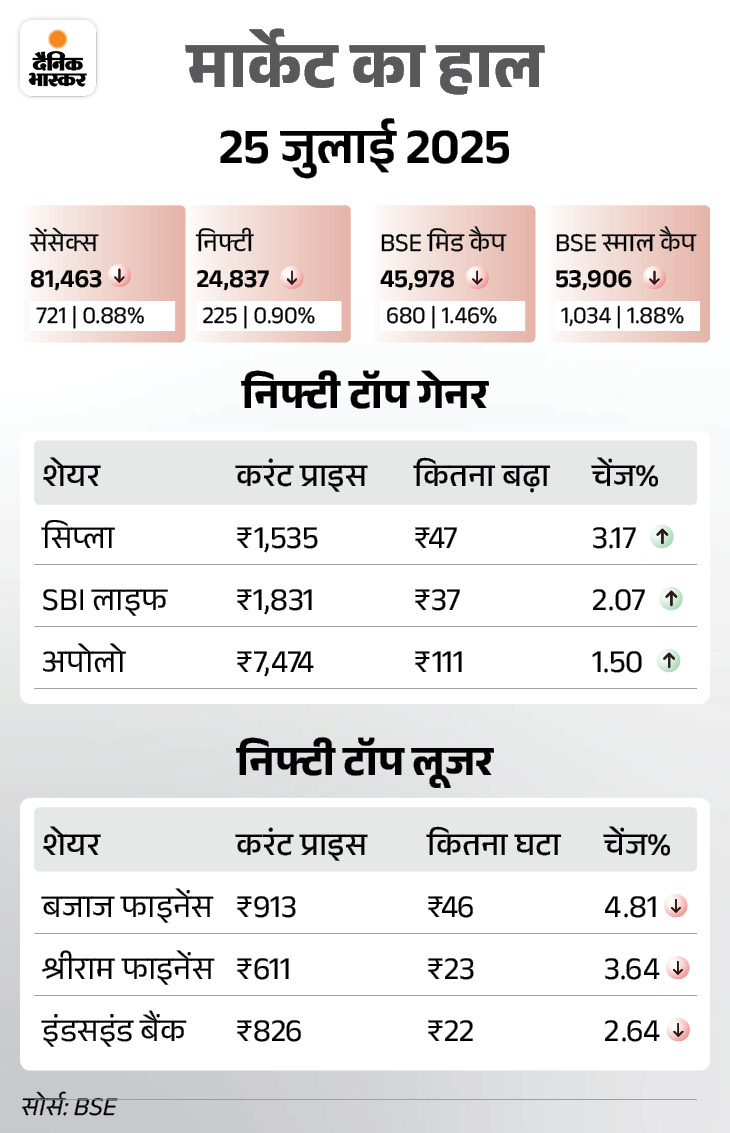

The Sensex fell 721 points to close at 81,463 on Friday (July 25) on the last trading day of the week.

The date of July 29 in the week starting tomorrow is important for the stock market. According to Harshubh Shah, director of wealth analytics, the trend reversal can appear on this day. That is, the market can make short-term tops or bottoms.

Apart from this, Indo-US trade deal, the result of the first quarter companies, the purchase and sale of foreign investors and technical factors will decide the market moves.

Let us understand what can happen in the market this week…

Support Zone: 24,850 | 24,805 | 24,676 | 24,538 | 24,450 | 24,355

Support means the level where the share or index falls from falling down. The price does not go down easily due to increasing shopping here. You can get a chance to shop at these levels.

Resistance Zone: 24,855 | 24,980 | 25,080 | 25,147 | 25,320 | 25,434

Resistance, ie, the level where the stock or index is hindered. This happens due to increasing selling. If the Nifty Registration crosses the zone, a new fast may occur.

Important date for stock market

Mark in your diary on 29 July. According to the analysis of the wealth, this is the date that can prove to be a game-changer this week. There is a possibility of trend reversal in the market on this day. That is, the market can make short-term tops or bottoms. Poogi traders should be alert on this day.

Momentum was shown on two dates last week

Wealthy said- 24-25 July described an important reversal zone for positive traders. The Nifty reversed at a high level of 25,246 on 24 July and the week ended at 24,806.

On July 22-23 was also described as important for Intrade Traders. On this day, there was a unilateral trick of the market with sharp Momentum.

Now 5 factors who can decide the direction of the market…

1. Results of companies: Adani Green Energy, Adani Total Gas, Majhgaon Dock Shipbuilders, NTPC Green Energy, RailTel Corporation of India, Hyundai Motor India, Interglobe Aviation, Dabur India, One Mobikwik Systems, Swigy, TVS Motor Company, Adani Power and Tata Power will release the company.

Apart from this, Nifty companies will include India Electronics (BEL), IndusInd Bank, Larsen & Tubr, Tata Steel, NTPC, Coal India, Eicher Motors, Hindustan Unilever (HUL), Mahindra & Mahindra (M&M), Maruti Suzuki India, Titan Intake and ITC.

The first quarter results of Kotak Mahindra Bank and IDFC Bank came after the market closure on Saturday. So everyone will keep an eye on the shares of these companies.

2. India-America Trade Deal: The two countries are trying to finalize the trade deal before 1 August. This date is important because the suspension period of trump-era tariffs is ending on this day. In this, additional duty of up to 26% was imposed on India. Investors will keep an eye on this.

3. Foreign Investor (FIIS): The movement of the market will also depend on what foreign institutional investors do. On Friday, FII sold shares worth Rs 1,979.96 crore.

While domestic institutional investors (DII) bought shares worth Rs 2,138.59 crore. After the net buyers for the last three months, in July, FIIs have been a net sellers worth Rs 6,503 crore so far.

4. Technical Factors: LKP Securities Senior Technical Analyst, Roopak Dey said- Nifty has slipped below the important support level of 24,900. Apart from this, it has closed below 50-day experienced moving average (50 EMA). This indicates weakness in the current trend.

He said, if the Nifty is unable to return above 24,900 in the next one or two sessions, then the bulls may have to face big challenges in the short-term. The bottom is at 24,700 immediate support. This is followed by support at 24,500. At the top is now around 25,000 resistance.

At the same time, according to SVP (Research), Ajit Mishra, SVP (Research) of Railways Broking Limited, the Nifty failed to break the resistance of 25,250 and slipped below 24,900. In this way the market trend is to go down further, with immediate support at 24,700 and major support is in the zone of 24,450–24,550. Upwards, the range of 25,100–25,250 will work as a major resistance zone

5. FOMC meeting: A very important Federal Open Market Committee (FOMC) meeting is starting from July 29 this week. Fed Chairman Jerome Powell will give information about the attitude of the Central Bank on the influence of the US economy, inflation and tariffs. The result of the meeting will be declared on July 30 and the interest rate is likely to remain unchanged.

The Sensex closed 721 points on Friday

The Sensex fell 721 points to close at 81,463 on Friday (July 25) on the last trading day of the week. The Nifty fell by 225 points, it closed at 24,837 levels.

Of the 30 shares of the Sensex, 29 declined and only one increased. Bajaj Finance shares fell 4.78%. Power grid, Tech Mahindra and Bajaj Finserv fell by 2.6%.