New Delhi12 minutes ago

- Copy link

Reliance Group companies said that this action would not affect their business, financial performance, or shareholders.

Raids at more than 35 places associated with Anil Ambani’s Reliance Group of Anil Ambani have been completed on Sunday. The action started on 24 July, which lasted for three days. The Red consists of about 50 companies. More than 25 people have also been questioned.

Reliance Group companies Reliance Power and Reliance Infrastructure informed this through exchange filing on Sunday. Both companies told the stock exchange that this action would not have any effect on their business, financial performance or shareholders.

According to media reports, a loan of Rs 3000 crore from Yes Bank was raided in Delhi and Mumbai in case of fraud case. The raid was conducted under Section 17 of the Prevention of Money Laundering Act (PMLA).

According to the news agency PTI, the action was taken on the basis of two FIRs registered by CBI and information received from agencies like SEBI, National Housing Bank, Bank of Baroda and National Financial Reporting Authority (NFRA).

The ED team arrived in the morning to raid companies associated with Anil Ambani’s Reliance Group.

Reliance Power and Reliance Infrastructure statement

The company said that the action of the Enforcement Directorate (ED) has ended everywhere. The company and all its officers have fully supported and will continue to cooperate with the officials.

This action of ED does not affect the company’s business, financial performance, shareholders, employees. This action is associated with allegations that relate to transactions older than 10 years of Reliance Communication Limited (RCom) or Reliance Home Finance Limited (RHFL).

Anil Ambani is not in the board of both companies, so action on RCom or RHFL will have no effect on their operations, management, or shareholders. Reliance Power and Infra is a separate and independent listed company that has no business or financial relations with RCom or RHFL.

Now understand the whole matter in 5 questions and answers:

Question 1: Why has ED action against Anil Ambani’s group?

answer: The case is related to a loan of about Rs 3,000 crore given by Yes Bank to Reliance Group companies associated with Anil Ambani between 2017 and 2019.

Initial investigations of the ED have revealed that these loans were allegedly diverted to fake companies and other units of the group. The investigation also revealed that the big officials of Yes Bank have probably been given bribe.

Question 2: What else came out in the ED investigation?

answer: The ED says that this was a “thoughtful and well-planned” plan, under which the money was grabbed by giving false information to banks, shareholders, investors and other public institutions. Many disturbances were caught in the investigation, such as:

- Loans to companies with weak or unnecessary verification.

- Many companies use the same director and address.

- The absence of necessary documents related to loan.

- Transfer money to fake companies.

- The process of giving new loans to repay the old loan (loan earrings).

Question 3: What is the role of CBI in this case?

answer: The CBI had registered an FIR in two cases. These cases are related to two different loans given by Yes Bank to Reliance Home Finance Limited and Reliance Commercial Finance Limited. In both cases, CBI took the name of former CEO Rana Kapoor of Yes Bank.

After this, an official said that other agencies and institutions like National Housing Bank, SEBI, National Financial Reporting Authority and Bank of Baroda also shared information with ED. Now ED is investigating this case.

Question 4: What was the impact on Anil Ambani’s companies?

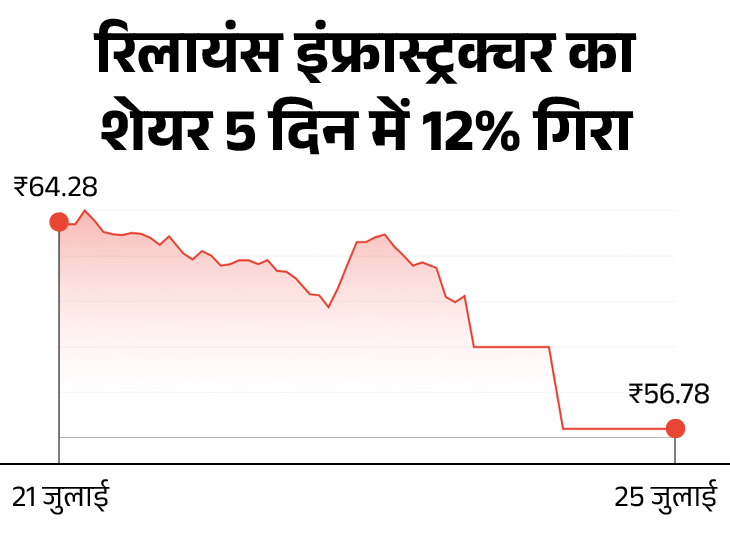

answer: After the raid, Anil Ambani’s two major companies, Reliance Infrastructure and Reliance Power shares have fallen by up to 10% in two days.

Question 5: What else are there on Anil Ambani companies?

Answer: A few days ago, State Bank of India declared Anil Ambani’s company Reliance Communications and Anil Ambani himself as “fraud”.

SBI says that RCom misused a loan of Rs 31,580 crore taken from the bank. Out of this, about Rs 13,667 crore was spent in repaying loans of other companies. 12,692 crore rupees were transferred to other companies of Reliance Group.

SBI also said that we are in the process of filing a complaint with the Central Bureau of Investigation (CBI) in this case. Apart from this, the action of Personal Insolvency (Insolvency) against Anil Ambani is also going on in the National Company Law Tribunal (NCLT) Mumbai.

This news also read Reliance Power’s stock crosses ₹ 70 after 10 years: Company shares gained 12% today, given 176% returns in a year

Anil Ambani’s company Reliance Power’s stock rose about 12% on Tuesday (June 10) on Tuesday. The company’s stock opened at Rs 65.69 in early trade. The stock then made a 52-wheel and day-high of Rs 72.23. Not only this, the company’s stock has reached beyond 70 rupees after 10 years. Earlier, the company’s stock was Rs 70 in November 2014. Read the full news