- Hindi news

- Business

- Upcoming IPOS 2025 details; Aditya Infotech | Lakshmi India IPO Price and Investment Detail

Mumbai2 minutes ago

- Copy link

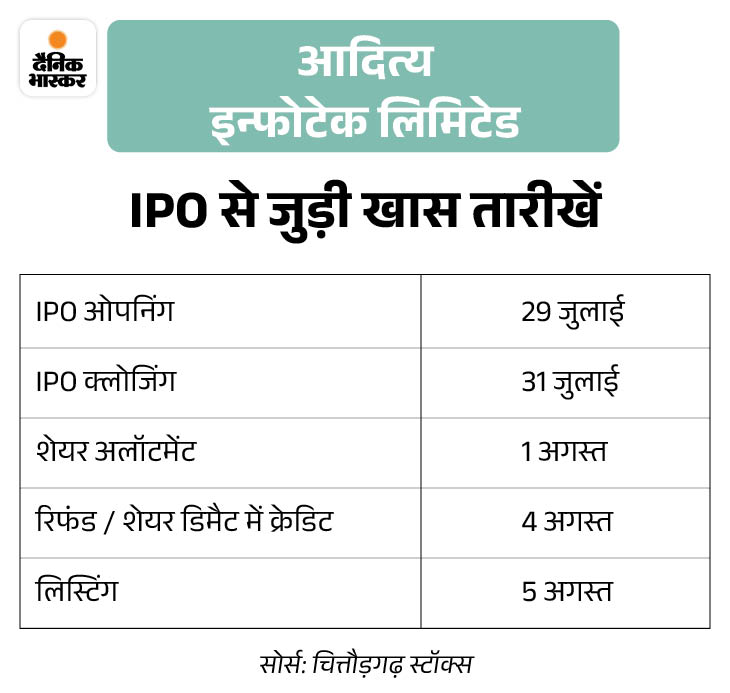

IPO The initial public offering of two companies is opening for those investing in today (Tuesday, July 29). Investors in IPO can invest minimum of Rs 14,850 by 31 July. The shares of both companies will be listed on August 5 in the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE).

Here information related to IPO is known in details …

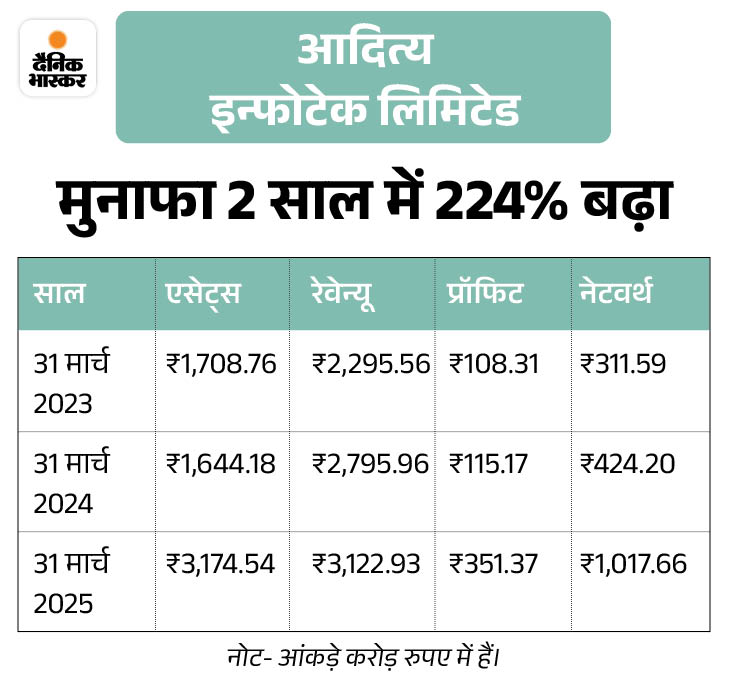

1. Aditya Infotech Limited

Aditya Infotech is bringing an IPO of Rs 1300 crore. In this issue, the company will issue 74 lakh new shares, which has a value of Rs 500 crore. At the same time, 1.19 crore shares are selling the current investors of the company through offer for sale (OFS), its value is Rs 800 crore. For this, you can invest minimum of Rs 14,850 till 31 July.

How much money can you spend minimum and maximum?

Aditya Infotech has fixed the price band of IPO ₹ 640 – ₹ 675. Retail investors can do bidding for minimum for 22 shares. If you apply for 1 lot for 1 lot at the rate of ₹ 675, the upper prize band of the IPO, then ₹ 14,850 will have to be invested for this.

At the same time, retail investors can apply for maximum 13 lots i.e. 286 shares. For this, investors will have to invest ₹ 1,93,050 according to the upper prize band.

15% of the issue reserved for retail investors

The company has reserved 75% of the IPO for qualified institutional buyers (QIB). Apart from this, 10% share is reserved for non-institutional investors (NII).

What does the company do?

Aditya Infotech Limited (AIL) also produces products related to video security and surveillance and also provides service. The company sells its products under the name ‘CP Plus’ brand.

The company creates smart home IOT cameras, HD analog systems, HD network cameras, body-worn and thermal cameras, as well as long distance IR cameras, and AI-Operate Solution (eg- Optomatic number plate recognition, people counting and heat mapping) products.

Ail Smart Wi-Fi cameras for users provide video surveillance products and service including smart Wi-Fi cameras, 4G-enabled cameras, dash cam. In the financial year 2025, the company provided service of 2986 stock keeping units (SKU) across the country and sold its products in more than 550 cities and towns.

,

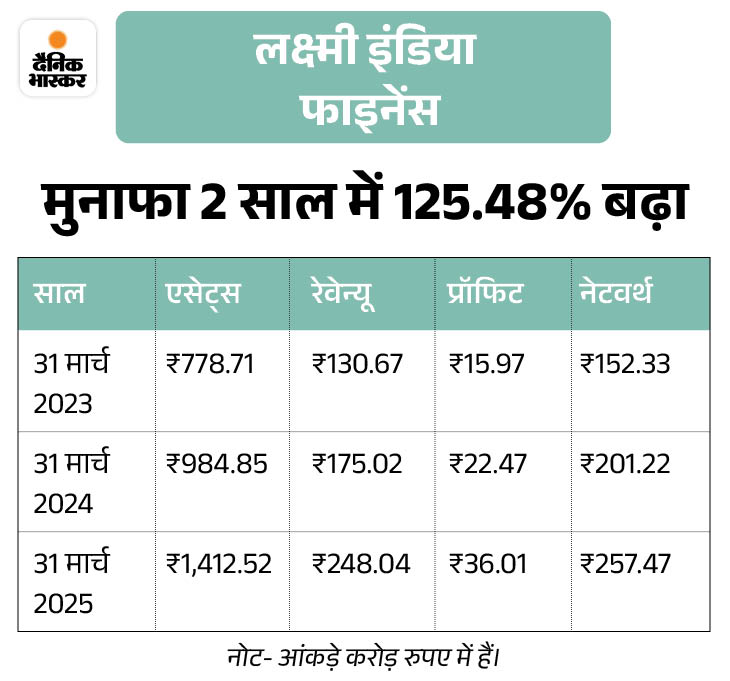

2. Lakshmi India Finance Limited

Laxmi India Finance is bringing an IPO of ₹ 254.26 crore. In this issue, the company will issue 1.05 crore new shares, which has a value of ₹ 165.17 crore. At the same time, the current investors of the company are selling through 56 lakh shares offers for sale (OFS), its value is Rs 89.09 crore. For this, you can invest minimum of Rs 14,852 till 31 July.

How much money can you spend minimum and maximum?

Laxmi Finance has fixed the price band of IPO ₹ 150 – ₹ 158. Retail investors can do bidding for minimum for 94 shares. If you apply for 1 lot of IPO’s Upper Prize Band ₹ 158, then you have to invest ₹ 14,852.

At the same time, retail investors can apply for maximum 13 lots i.e. 1,222 shares. For this, investors will have to invest ₹ 1,93,076 according to the upper prize band.

35% of the issue reserved for retail investors

The company has reserved 50% of the IPO for qualified Institutional Buyers (QIB). Apart from this, 35% share is reserved for non-institutional investors (NII).

What does the company do?

Laxmi India Finance Limited is a non-banking finance company. It was established in 1996. The company provides MSME loan, vehicle loan, construction loan and many other loans. The company gives more than 80% of MSME of its total loan. Laxmi India has a net worth of Rs 257.47 crore. The company has made a profit of Rs 36.01 crore in the financial year ended on 31 March 2025.

What is IPO?

If a company issues its shares for the common people for the first time, then it is called an initial public offering i.e. IPO. The company needs money to increase business. In such a situation, instead of taking loans from the market, the company raises money by selling some shares to public or issuing new share. For this, the company brings IPO.

,

Read this news too …

14 IPO will open in the stock market this week: 5 companies in the mainboard segment will raise ₹ 7,008 crore, NSDL’s IPO will open on July 30

The traders starting on July 28 in the stock market will open the total 14 public issues i.e. IPO. Of these, 5 are from IPO mainboard segment. Apart from this, 12 companies will have a listing in the stock market.

These 14 companies will raise Rs 7,300 crore from the IPO. At the same time, 5 companies in the mainboard segment have a plan to raise Rs 7,008 crore. MSME Lander Lander India Finance and Video Security and Surveillance Products Maker Aditya Infotech’s IPO from the mainboard segment will open on 29 July next week.

Read full news …