New Delhi2 minutes ago

- Copy link

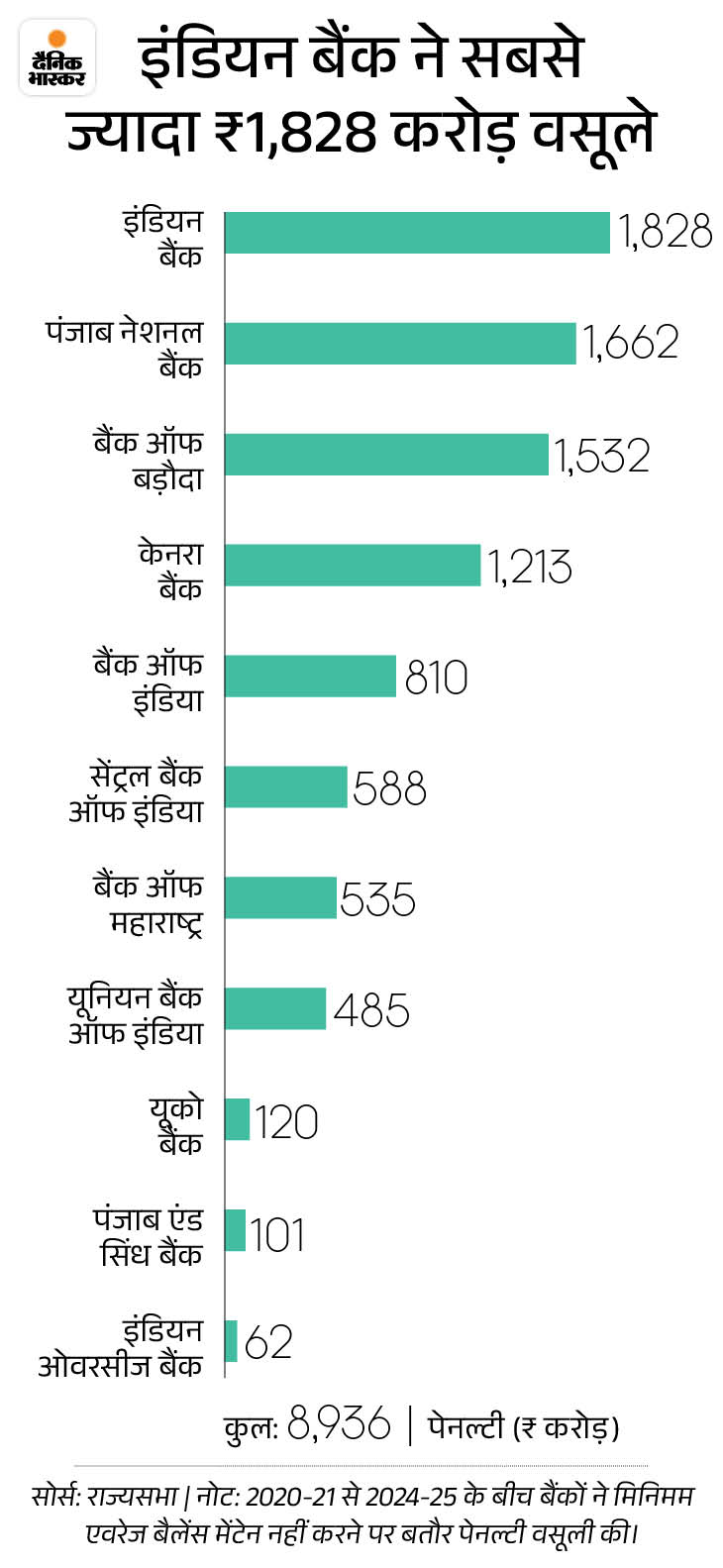

The country has recovered a penalty of about Rs 9,000 crore from customers for not maintaining a minimum average balance in a savings account in the last 5 years.

Some public sector banks recovered penalty from customers for not having a monthly minimum amount in the account, while some recovered it on a quarterly basis.

However, accounts like Prime Minister Jan Dhan account, Basic Saving Bank Deposit Account and Salary Account are exempted from minimum balance.

Private banks are not accepting the government

Minister of State for Finance Pankaj Chaudhary gave this information in response to a question in Rajya Sabha. The minister said that, the Department of Financial Services (DFS) has advised banks to rationalize the penalty to be recovered if they do not have a minimum average balance (MAB).

It has especially emphasized on giving relief to customers in semi-urban and rural areas. It seems that 7 out of 11 public sector banks have followed this advice. The other 4 banks have also said to do so soon. But many private banks are not doing this.

Why are some banks still charging these fees?

Under the RBI guideline, banks can decide penalty according to the policies approved by their board. But this fine should be as a certain percentage at the difference between the real balance and the accountable minimum balance when opening the accounts.