Mumbai4 minutes ago

- Copy link

Foreign Portfolio Investors (FPI) has so far withdrawn around Rs 18,000 crore from the Indian stock market in August 2025. According to depository data, this year FPI has withdrawn the total of Rs 1.13 lakh crore from the Indian stock market so far.

According to the data, FPI has sold shares worth Rs 17,924 crore this month (till August 8). In July, foreign investors withdrew Rs 17,741 crore on net basis.

Earlier, from March to June i.e. in three months, FPI invested Rs 38,673 crore. But recent trading stress and weak corporate results changed the market environment.

FPI buyers remained on Friday

At the same time, on the last trading day of the past week i.e. Friday, foreign portfolio investors and domestic institutional investors i.e. DII Net Buyers remained. According to NSE data, on August 8, FPI bought shares worth Rs 1,932.81 crore and DII bought shares worth Rs 7,723.66 crore.

During the trading session, DIIS bought shares worth Rs 16,682.09 crore and sold shares worth Rs 8,958.43 crore. At the same time, FII bought shares worth Rs 17,682.11 crore and sold shares worth Rs 15,749.30 crore.

The reason for FPI withdrawal in August

The main reasons for the withdrawal of FPI in August are the increasing trading tension between Indo-US, disappointing results of the first quarter of corporate companies and weakness in Indian rupee.

According to Angel One Senior Fundamental Analyst Vakrajaved Khan, FPI’s stance will be delicate and risky in the coming times. He said that issues like business policies and tariffs would be important for investors next week.

Why is there evacuation?

Himanshu Srivastava, Associate Director of Morningstar Investment Research India, said that from August 1 of the US, the market was nervous due to imposing 25% tariffs on Indian goods and increasing it 25% this week. This inspired FPI to sell massively in Indian shares.

Apart from this, growth growth in American Treasury Yield also attracted foreign investors to Treasury, leading to increased capital withdrawal from the Indian market.

FPI investment in loan market

However, despite the withdrawal from the stock market, FPI continued investing in the loan market. In August, he invested Rs 3,432 crore in the Date General Limit and Rs 58 crore in the Date Voluntary Retention Route.

What will happen next?

Analysts believe that the FPI’s stand will be cautious amidst global economic uncertainties and talks on Indo-US trade policies. The coming weeks for the Indian stock market can be challenging, as investors will closely monitor global and local reasons.

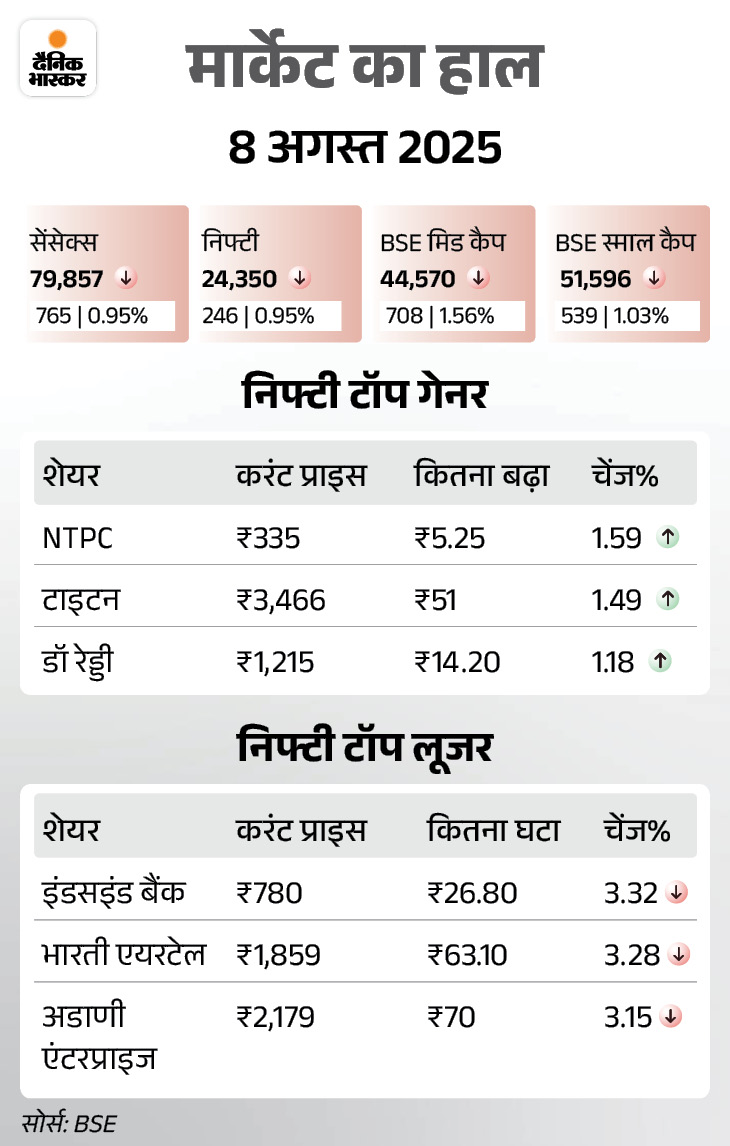

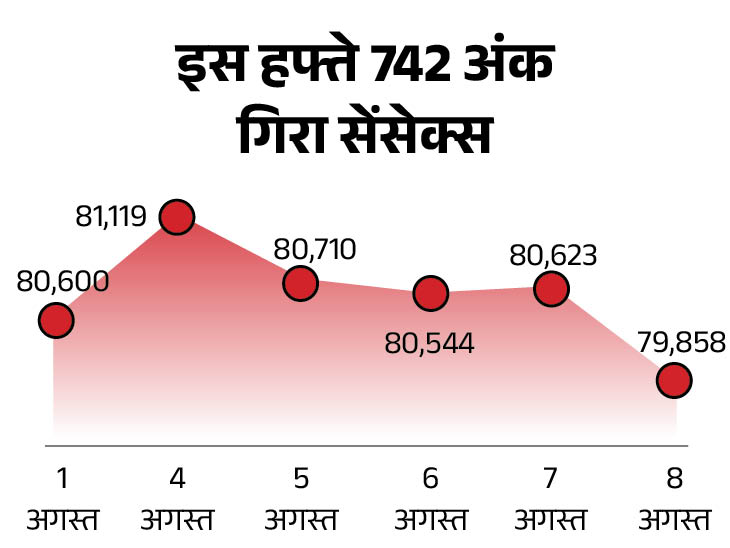

Sensex dropped 742 points this week

The Sensex declined by 742 this week after a week -long trading. The Sensex closed at 80,600 on 1 August. The last trading day of the week came at 79,858 on 8 August.

On Friday, the Sensex fell 765 points to close at 79,858. After 4 months it came below 80 thousand. Earlier on May 9, the market came to 79,454.

The Nifty also fell by 246 points, it closed at 24,350. Of the 30 shares of the Sensex, there was a rise in 5 and a decline in 25. Metal, IT, Auto and Realty sector shares declined significantly.