Mumbai3 minutes ago

- Copy link

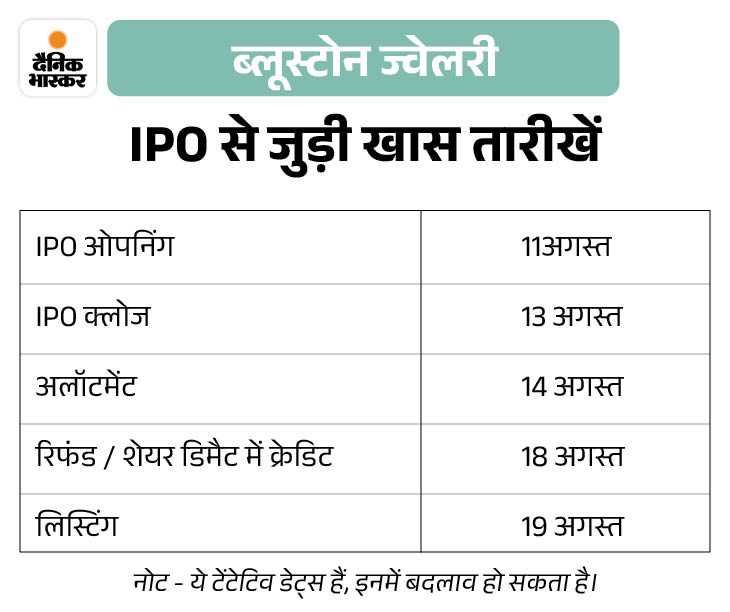

The IPO of Bluestone Jewelery and Lifestyle Limited (BJLL), a modern style jewelery -making company called ‘Bluestone’ brand, has been opened from today i.e. August 11.

Investors will be able to bid till August 13 for this issue. On August 19, the company shares will be listed on Bombay Stock Exchange (BSE) and National Stock Exchange (NSE). The company wants to raise Rs 1,540.65 crore through this IPO.

2.98 crore shares will be sold in this IPO. In this, the company will issue 1.59 fresh shares, which is value of Rs 820 crore. At the same time, the current investors of the company will sell 1.39 crore shares through the Offer for Sale (OFS), which has a value of ₹ 720.65 crore.

How much money can you spend minimum and maximum?

Bluestone Limited has fixed the price band of IPO between ₹ 492 and ₹ 517. Retail investors can do bidding for minimum for a lot ie 29 shares. If you apply for 1 lot of IPO’s Upper Prize Band ₹ 517, then ₹ 14,993 will have to be invested for this.

At the same time, retail investors can apply for maximum 13 lots i.e. 377 shares. For this, investors will have to invest ₹ 1,94,909 according to the upper prize band.

35% of the issue reserved for retail investors

The company has reserved 75% of the IPO for qualified institutional buyers (QIB). In addition, 15% share is reserved for non-institutional investors (NII) and 10% of the remaining 10% for retail investors. What is IPO?

When a company releases its shares for the common people for the first time, it is called an initial public offering i.e. IPO. The company needs money to increase business. In such a situation, instead of taking loans from the market, the company raises money by selling some shares to public or issuing new share. For this, the company brings IPO.