New DelhiA few moments ago

- Copy link

Giving relief to the account holders of ICICI Bank, the minimum balance has been reduced to 15 thousand. Earlier, the company had asked customers to maintain minimum balance of at least 50 thousand rupees.

According to the new order, this limit in semi-ibn (semi-urban) will be ₹ 7,500 and now in rural areas, ₹ 2,500 as before. Due to this, customers may have to pay penalty if there is less balance. The new rule will apply to new accounts opened after 1 August 2025.

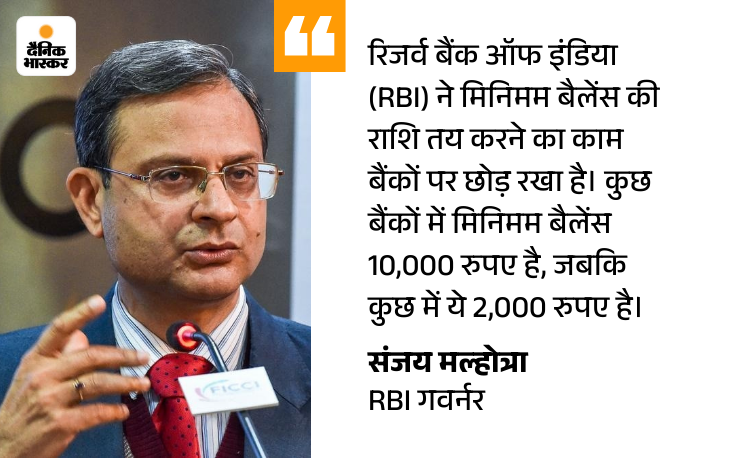

At the same time, on Tuesday, RBI Governor Sanjay Malhotra said that banks decide how much money to keep in the savings account, the banks decide, the RBI has no participation in it. He said this on the question of journalists during a program related to financial inclusion in Gujarat.

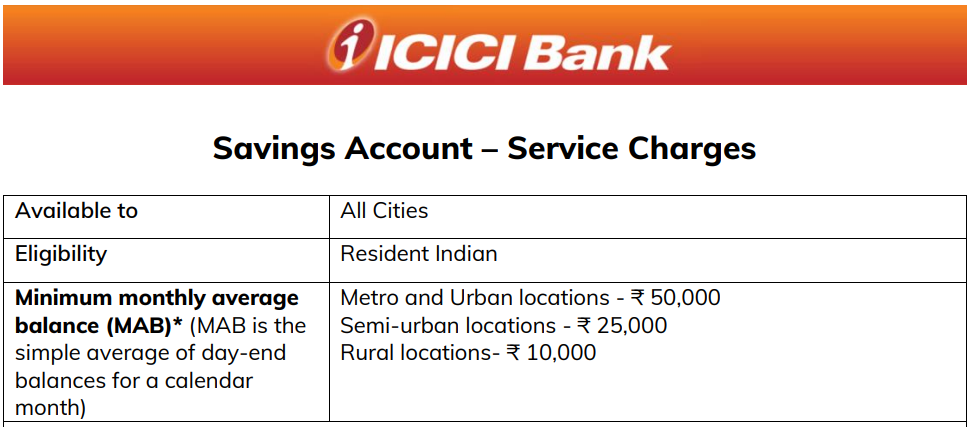

ICICI had earlier done minimum ₹ 50,000

ICICI issued an order 4 days ago, saying that the bank account holders will now have to maintain a minimum balance of 50 thousand rupees in their account. Due to this, customers may have to pay penalty if there is less balance.

The limits of keeping minimum balance in the account were different in the villages and metro cities, the bank had all increased. The limit was now Rs 10,000 for at least Rs 50,000 in metro and urban areas, Rs 25,000 in semi-ibn (semi-urban) areas and open accounts in villages.

For the first time since 2015, bank increased the limit of minimum balance

Earlier, there was a need to maintain at least 10 thousand rupees in the metro and urban areas, 5000 rupees in cm-urban and at least 2500 rupees in the village branch.

With this increase in the limit of minimum account balance, the limit to hold the highest minimum account balance (MAB) in domestic banks has now become ICICI. The bank has changed the minimum balance limit after 10 years.

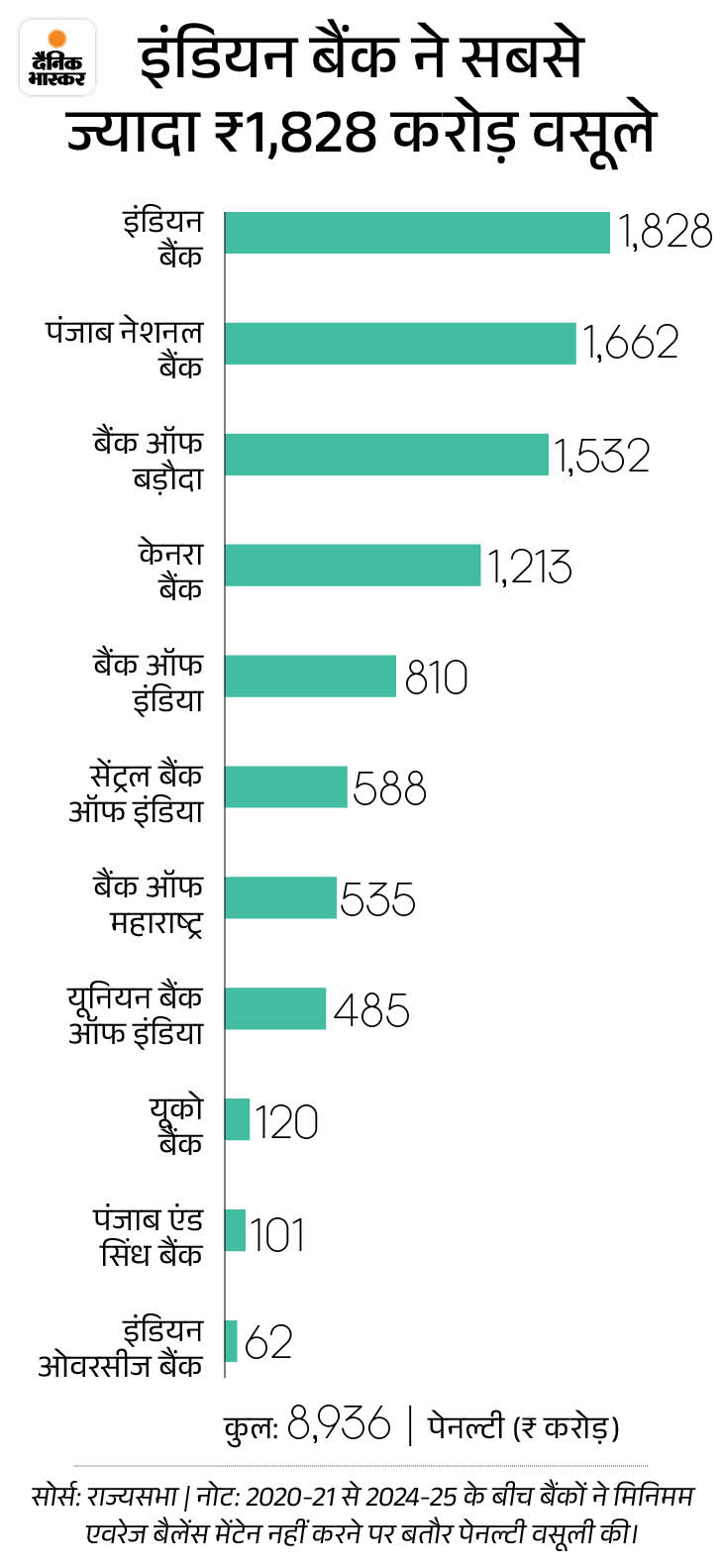

The country has recovered a penalty of about Rs 9,000 crore from customers for not maintaining a minimum average balance in a savings account in the last 5 years …

Minimum balance and penalty rules in top banks of the country

If you have less money than the minimum balance fixed for a month in your account, then you will have to pay 6% charge or 500 rupees (which is less). Suppose, the minimum balance fixed for your account is Rs 10,000. But in some month you only maintained 8000 rupees, that is, you will have to pay a reduction of 2000 rupees, ie 6% of ₹ 2000 i.e. 120 rupees penalty.

However, the needs of maintaining minimum balance for saving account in Indian banks are different. These rules can vary depending on the bank, the type of account type, and where the account is at the basis of the account (metro, urban, semi-urban, rural).

1. State Bank of India (SBI)

- Minimum balance: No minimum balance is necessary for all savings accounts since 2020.

- Rule: Basic Saving Bank Deposit Account (BSBDA) and Jan Dhan account are zero-balance. No penalty.

2. Punjab National Bank (PNB)

- Minimum balance: There is no minimum balance penalty since July 2025.

- Rule: Zero-balance accounts available to promote financial inclusion.

3. HDFC Bank:

- Minimum balance: Big city: ₹ 10,000; Small town: ₹ 5,000; Rural: ₹ 2,500.

- Rule: Penalty: up to ₹ 600. Possible increase from April 2025.

4. Axis Bank:

- Minimum balance: Big city- ₹ 12,000; Small town: ₹ 5,000; Rural: ₹ 2,500.

- Rule: Zero-balance accounts available. Penalty: Depending on account type.

5. Bank of Baroda

- Minimum balance: There is no penalty in normal savings accounts since July 2025. ₹ 500 – ₹ 2,000 (based on location) in premium accounts.

- Rule: Zero-balance options available in some accounts.

,

Read this news too …

ICICI Bank’s profit increased by 15% to ₹ 12,768 crore: Earning in the first quarter was ₹ 51,452 crore, the bank’s stock climbed 14% in a year

ICICI Bank has earned a total of ₹ 51,452 crore in the first quarter (April-June 2026). Out of this earnings, the bank spent Rs 32,706 crore in works like salary, electricity bill, deposit.

After this, the bank survived as a profit of Rs 12,768 crore. The bank made a profit of Rs 11,059 crore in the same period of a year ago. The annual basis has increased by 15.45%.

Read full news …