Mumbai5 minutes ago

- Copy link

Gen Street is an American trading company that uses high-technology and quantitative trading ie Mathematical models in the stock market.

America’s high-frequency trading company Jane Street has received approval to start trading again in the Indian stock market. This information has been revealed by a report by Reuters.

But now the company has assured SEBI that it will not trading in options. The cash will not land in the market even until she completely satisfies SEBI about her trading strategy.

Understand the whole matter in 4 points ..

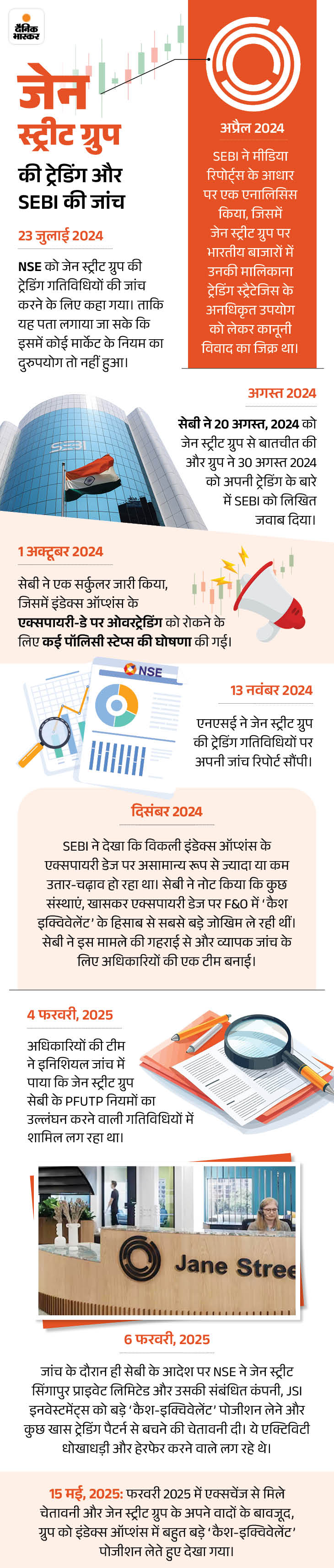

- SEBI had banned the trading of Jane Street on 3 July 2025. SEBI said that Jane Street manipulated the major indexes like Nifty and Bank Nifty, which made it a huge profit.

- SEBI investigation found that from January 2023 to May 2025, Gen Street had earned a profit of Rs 36,671 crore, of which Rs 4,844 crore was considered as illegal profits.

- She was instructed that if she wants to start the trading again, she would have to deposit Rs 4,844 crore in an escrow account. Jane Street deposited this amount on 11 July.

- After this, on July 18, SEBI allowed him to trading. However, SEBI also made it clear that Jane Street would have to avoid trading patterns that the market regulator considered manipulative.

Jane Street denied allegations of rigging

Jane Street has denied SEBI’s allegations. The company says that the trading it did was a general index arbitration strategy, taking advantage of the price difference in the market.

The company said in an internal memo sent to its employees that SEBI has misunderstood their trading. Jane Street also said that she is trying to resolve the matter with SEBI.

However, the company has made it clear that it will not do options trading in India at the moment. Gen Street’s stake in derivatives in India was 5 to 7 times more than normal shares.

Difference between arbitrase strategy and market manipulation

Arbitrase is a valid trading strategy. In this, the trader takes advantage of the difference in the prices of a share, commodity or derivatives in different markets or platforms at the same time.

Suppose, a company shares are being sold for Rs 100 on Bombay Stock Exchange (BSE), but for Rs 102 on the National Stock Exchange (NSE). The trader purchases shares from BSE and sells it immediately on NSE and earns a profit of Rs 2. This is completely legal.

Market manipulation is illegal activity. In this, a trader or any institution deliberately affects the prices of shares or other financial instruments, so that it incorrectly profit or loss to others.

Suppose, a trader buys shares of a company in large quantities and spreads the rumor that the company has got a big contract. This increases the share price, and sells it at a high price.

Jane Street will challenge SEBI order in court

Jane Street has deposited Rs 4,844 crore following SEBI’s order, but is preparing to challenge SEBI’s allegations in court. The company has hired a large law firm like Khaitan and Company for this. Experts say Gen Street may claim that SEBI issued an interim order without hearing, which could be proactively wrong.

SEBI will also check Sensex options contracts

SEBI has allowed Jane Street to trading, but NSE and BSE have been asked to closely monitor Jane Street’s future trades. SEBI has also said that if Jane Street again adopted a manpulative trading pattern, strict action will be taken on it.

SEBI investigation is still going on and may take several months. SEBI has now decided to look at not only bank Nifty and Nifty 50, but also Sensex options contracts. SEBI suspects that Jane Street may have manipulated the BSE index.

To read how Jane Street used to manipulate the market in detail, go to the link given below ….

SEBI has banned the American trading firm Jane Street Group and 3 companies related to it. The American trading firm has been accused of rigging prices on the day of index expiry. SEBI has also ordered to seize illegal earnings of Rs 4,843.57 crore.

Read full news …