Mumbai3 minutes ago

- Copy link

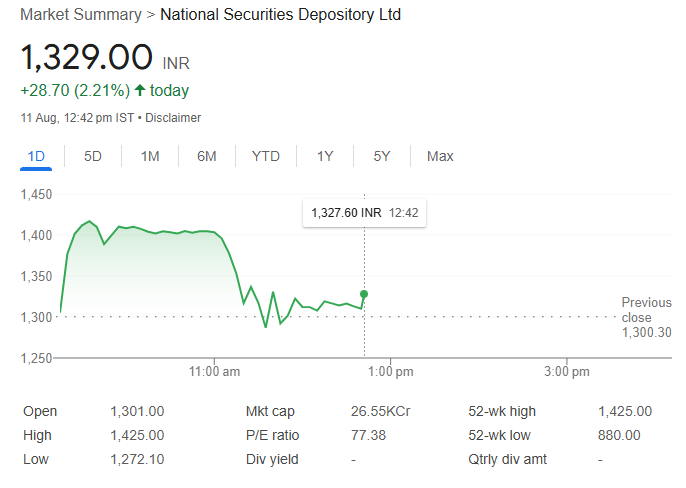

The National Securities Depository Limited has climbed more than 60% since the share listing of NSDL. Today, its stock saw a rise of about 10% in Sabuh business. The stock made a high of ₹ 1425. The issue of this stock was ₹ 800 and the listing was at ₹ 880.

With this speed, the market value of NSDL i.e. Market Capitalization has reached close to Rs 28,000 crore. The company raised Rs 4,011 crore from this IPO. This was a completely offer for sale, that is, the current shareholders sold their stake.

In the morning, NSDL shares had a gain of about 10%. However, later this boom increased to 10% to 2%.

SBI’s investment of ₹ 1.20 crore changed to ₹ 779 crore

- State Bank of India bought 6 million shares (3% stake) of NSDL at a price of just Rs 2 per share. The value of investment of Rs 1.20 crore has been Rs 779 crore today.

- IDBI Bank also bought 2.99 crore shares (14.99% stake) at a price of Rs 2 per share. IDBI’s investment of Rs 5.996 crore has now changed to Rs 3,898 crore.

- Specified Undertaking of Unit Trust of India bought 1.0245 crore shares (5.12% stake) at a price of ₹ 2 per share. The value of investment of ₹ 2.049 crore has been ₹ 1,332 crore.

- The NSE bought the shares at an average price of Rs 12.28 per share. The NSE sold its 9% stake in the IPO, but still has 2.9999 million shares (15% stake). Their cost was Rs 36.84 crore, which has now increased to Rs 3,900.90 crore.

- HDFC Bank had purchased 1.38995 crore shares (6.95% stake) at a price of ₹ 108.29 per share, ie a total investment of ₹ 150.54 crore. Now the price of these shares is ₹ 1,657.54 crore.

- Union Bank bought 51.25 lakh shares (2.56% stake) at a price of Rs 5.20 per share, ie a total investment of Rs 2.665 crore. Now the value of these shares is 666.90 crores.

How is the company’s financial health?

Company in financial year 2024-25 (FY25):

- Net Profit: 343.12 crore rupees, which is 24.57% more than 275.45 crore in the previous year.

- Revenue: 1,535.19 crore, which is 12.41% more than 1,365.71 crore of FY24.

- Market Cap: The market cap will be around Rs 16,000 crore at an upper price of Rs 800.

The company’s price-to-aranings (P/e) ratio is 46.62, which is less than 66.63 P/E of its Competitator Central Depository Services Limited (CDSL).

Investors advise to hold share

Gaurav Garg of Lemon Markets Desk said- “We are positive about NSDL, as it is a leader in the institutional depository segment and has a key role in providing custodial and depository services to mutual funds, insurance companies, banks and foreign portfolio investors (FPIs).

Given the strong market status, the possibility of stable income and proper valuation, we advise investors who have allocated shares to hold it with a long -term perspective ”.

What is NSDL and its work?

NSDL is a depository institution. That is, it works to keep shares, bonds and other securities in digital form in your demat account.

Just as the bank keeps your money safe, NSDL keeps shares safe in demat account. This company, formed in 1996, is today the largest depository in the country.