Mumbai6 minutes ago

- Copy link

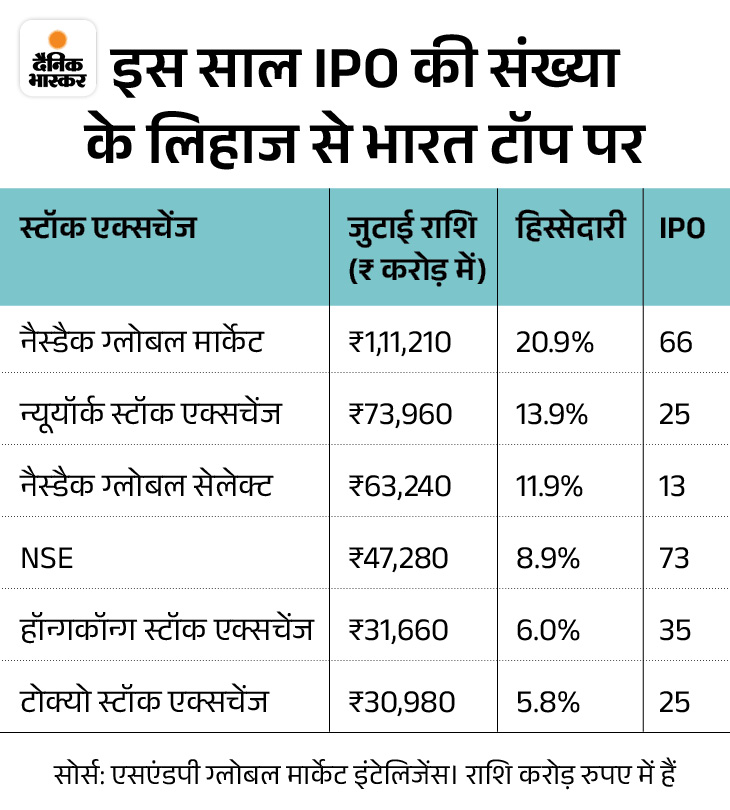

A total of 5.31 lakh crore rupees were raised through IPO worldwide during January-June.

The National Stock Exchange (NSE) of India has achieved a major achievement in the first half of 2025. During this period, the National Stock Exchange (NSE) stood fourth in the list of Global IPO with a fund offer of Rs 47,000 crore.

In terms of the number of issues, he topped the 73 IPO. Nasdaq 66 stood second with IPO. According to the report of S&P Global Market Intelligence, a total of Rs 5.31 lakh crore was raised through IPO worldwide in the first half.

The NSE shares in this were 9%. In this list, Nasdaq Global Market, NYSE and Nasdaq Global Select Market were at the top. These exchanges raised 2.5 lakh crore, which is 47% of the total amount raised.

24% less than last year, 36% more

- According to S&P Global Market Intelligence, 119 IPOs came in NSE-BSE during the first six months of 2025. He raised Rs 51,150 crore.

- In the same period in 2024, an amount of Rs 37,682 crore was raised through 157 IPO. That is, 24% less IPO came in terms of number. But he raised 36% more amount.

- Indian exchanges raised a total of Rs 1.7 lakh crore in 2024 through 333 new listings.

- The analyst estimates that if the secondary markets remain favorable, IPO activities in India will remain strong in the second half (July-December) of 2025.

What is IPO?

When a company releases its shares for the common people for the first time, it is called an initial public offering i.e. IPO. The company needs money to increase business. In such a situation, instead of taking loans from the market, the company raises money by selling some shares to public or issuing new share. For this, the company brings IPO.

,

Read this news too …

Ipo of the Ipo of Anthem Biosciences will have to invest minimum ₹ 14,820 today

The IPO of Anthem Biosciences Limited has been opened today i.e. from July 14. Retail investors will be able to bid in it by 16 July. The company wants to raise Rs 3395 crore through this IPO. 5.96 crore shares will be sold in this IPO.

This IPO is completely offer for sale (offs). That is, the existing shareholders of the company (such as promoters, investors or other big shareholders) will introduce the public to sell the shares of the company with them. This means that the company is not issuing new shares to raise money, but already existing shares are being sold.

Click here to read the full news …