New Delhi10 minutes ago

- Copy link

The post office has started the process of identifying and freezing accounts associated with Small Savings Schemes which are not active even for three years after matching. Its purpose is to protect the amount of these money and stop unauthorized transactions. The Department of Posts will examine such accounts in January and July.

If your account is matured and you have neither withdrawn the amount nor extended the period, it will be freeze. That is, you will not be able to use deposits, withdrawal or online service.

Which accounts will affect? This rule will apply to all major small savings schemes, such as: Time Deposit, Monthly Income Scheme, PPF, Senior Citizen Savings Scheme, Kisan Vikas Patra, National Savings Certificate (NSC), Recurring Deposit.

How to activate the account again? If your account is freeze, then to make it activated again, you will be able to go to the nearby post office and start eating documents related to your identity.

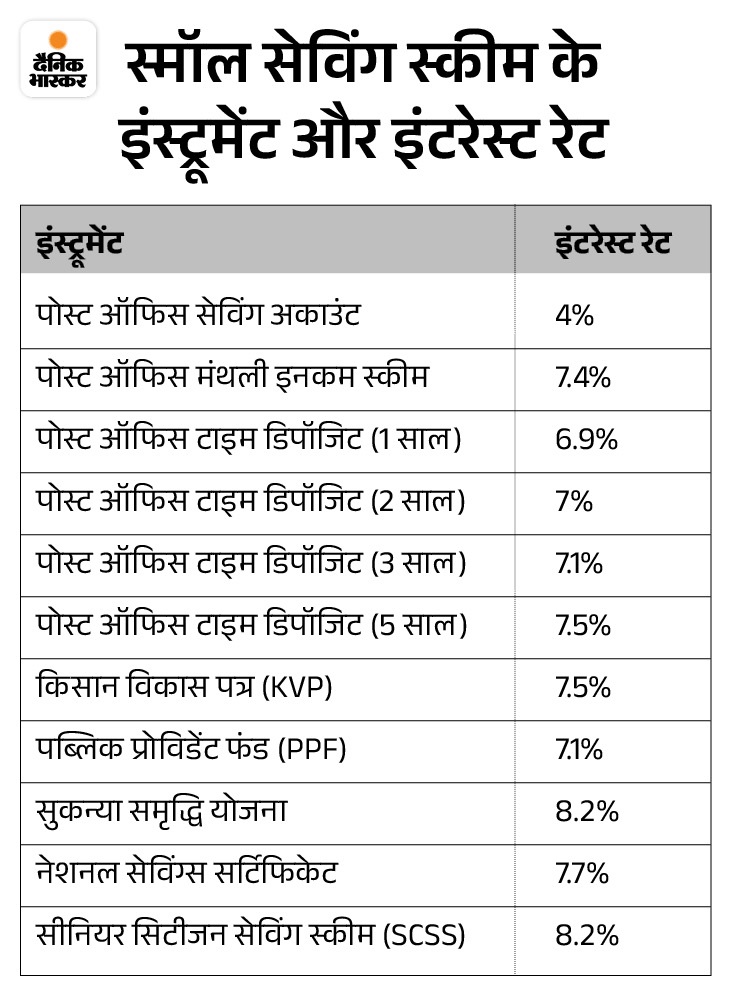

7.1% interest rate on public provident fund Currently, 7.1% annual interest is being received on Public Provident Fund (PPF). At the same time, 8.2% interest is being received on Senior Citizen Savings Scheme and Sukanya Samriddhi Yojana. Interest rates on small savings schemes are between 4% to 8.2%.

This scheme is the major source of household saving Small Saving Scheme is a major source of household saving in India and includes 12 instruments. In these schemes, depositors get interest on their money. The collection from all small savings schemes is deposited in the National Small Savings Fund (NSSF). Small saving schemes have emerged as a source of government deficit financeing.

Classification

Small saving instruments can be divided into three parts:

- Postal Deposit: Saving Account, Recursing Deposit, Time Deposit and Monthly Income Scheme

- Saving Certificate: National Small Saving Certificate (NSC) and Kisan Development Patra (KVP)

- Social Security Schemes: Sukanya Samriddhi Yojana, Public Provident Fund (PPF) and Senior Citizen Savings Scheme (SCSS)