New Delhi3 minutes ago

- Copy link

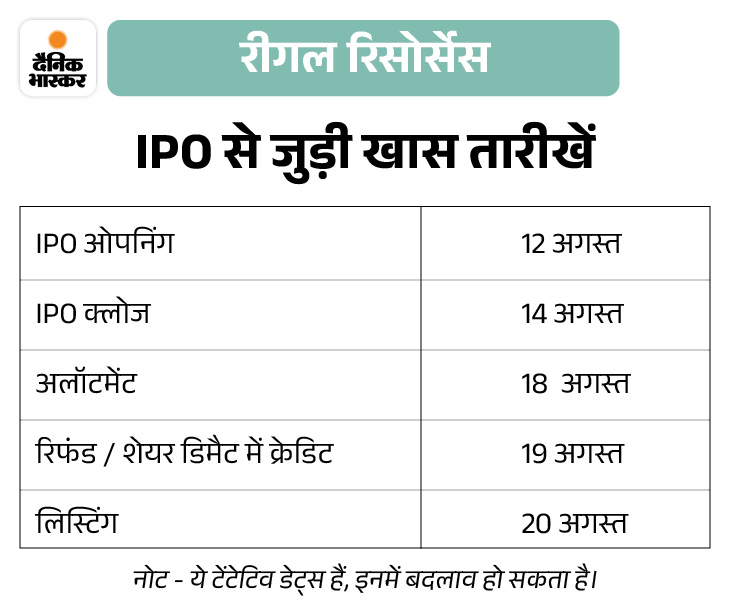

Today (Thursday, August 14) is the last chance to invest in the IPO of Regal Resources. This IPO has been subscribed to 26 times in two days. It has subscribed 22 times in retail, 68 times in NII and 3.36 times in QIB.

Through this issue, the company wants to raise the total of Rs 306 crore. The company has shared fresh shares of Rs 2.06 crore for this, its value is ₹ 210 crore. Along with this, the current investors of Regal will sell 94 lakh shares through the offer for sale, which has a value of ₹ 96 crore.

How much money can you spend minimum and maximum?

Regal Resources has fixed the price band of the IPO ₹ 96 – 102. Retail investors can do bidding for minimum for 144 shares. If you apply for 1 lot of IPO’s Upper Prize Band ₹ 102, then you have to invest ₹ 14,688.

At the same time, retail investors can apply for maximum 13 lots i.e. 1,872 shares. For this, investors will have to invest ₹ 1,90,944 according to the upper prize band.

For detailed information related to IPO, Bhaskar spoke to the company’s President Anil Kishorepuria and Holtime Director Karan Kishorepuria, read the main part of the conversation …

Question 1 – Tell us about Regal Resources, how was its journey so far?

answer- It is a corn milling company and Mecca is its raw material. In this, we grind and crush maize, which makes Menly four products- carbohydrates, starch, protin (gluten) and germ. They are used to make animal consumption, maize oil, fiber. The company started in 2012 and commercial production started September 2018. Then our production capacity was 180 tonnes, which has now increased to 825 tonnes.

3. Question- According to the season, there is any effect in the price of maize?

answer- Our company is Bihar based and has a Bengal boarder. Bihar has a production of 55 million tonnes of maize annually and 20 million tonnes in Bengal. We are just 1 km from Bengal. In this sense, there is a total availability of 75 lakh tonnes of goods for us. Therefore, we buy 90% of our total convention from the season at the time of time i.e. Rabi. This does not affect the price flakeation of the off-season. The advantage of this is that we can tell how much the price of our final production will be next year.

Question 3. What is the share of domestic cell and export in your earnings?

answer- We sell our 91% production in domestic market and only export 9%. Talking about the region-wise, 40% in the eastern part of India, 25-30% in the northern part. The rest of the goods currently go to Maharashtra, Gujarat, and Rajasthan, it has just started a few days ago.

Question 4. Why will a farmer be associated with Regal Resources?

answer- In the area where our production unit is, nearby farmers grow around 6 lakh tonnes of maize. They go to sell this 6 lakh tonnes in three mandis…

- First, Gulab Bagh Mandi Purnia is one of the largest mandis in the country. Its distance is 110 kilometers.

- Second, Dalkola is the mandi, it is 70 kilometers.

- Third, Kishanganj is about 50 kilometers.

Therefore, local farmers come to us instead of going to these mandis. Bihar connect is also a factor in this. Apart from this, we have also launched the Kisan Friendship Program. In this, farmers are given many types of additional benefits as additional incentives. This is based on the capacity to sell their goods.

- Last year, we gifted Tata Panch to 6 farmers selling more than 6 thousand tonnes of goods.

- This year, we are giving heavy duty tractors to 8 farmers who are giving more than 8 thousand tonnes of goods.

- This gives gifts like Royal Enfield bikes, washing machines, sewing machines and mobile phones to the farmers who sell less than this.

Saval 5. What new is bringing new in value added products?

answer- This year we are going to produce 1600 tonnes. It is adding liquid glucose and mantodiction powder, modified starch. By July next year, dextrohydras and monohydras are being made which will be used in the formation.

Question 6. What are you doing to increase profit margin?

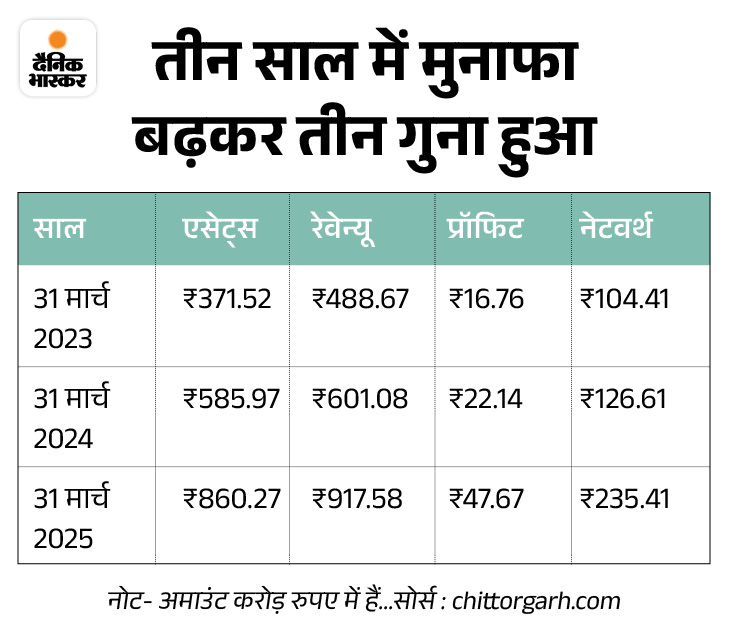

answer- Three years ago our profit after tax was Rs 16 crore, which has now increased to 47 crores. The company’s stock is also growing 36% annually (CAGR). When we double the production, the profit will also increase in the same proportion that we are doing. The growth caused by the value edition in the product will be seen in more profit than our revenue.

35% of the issue reserved for retail investors

The company has reserved 50% of the IPO for qualified Institutional Buyers (QIB). Apart from this, 35% share is reserved for non-institutional investors (NII).