- Hindi news

- Business

- Reliance | Top 10 Companies Market Cap August 2025 List; LIC TCS SBI HDFC Bank

Mumbai2 minutes ago

- Copy link

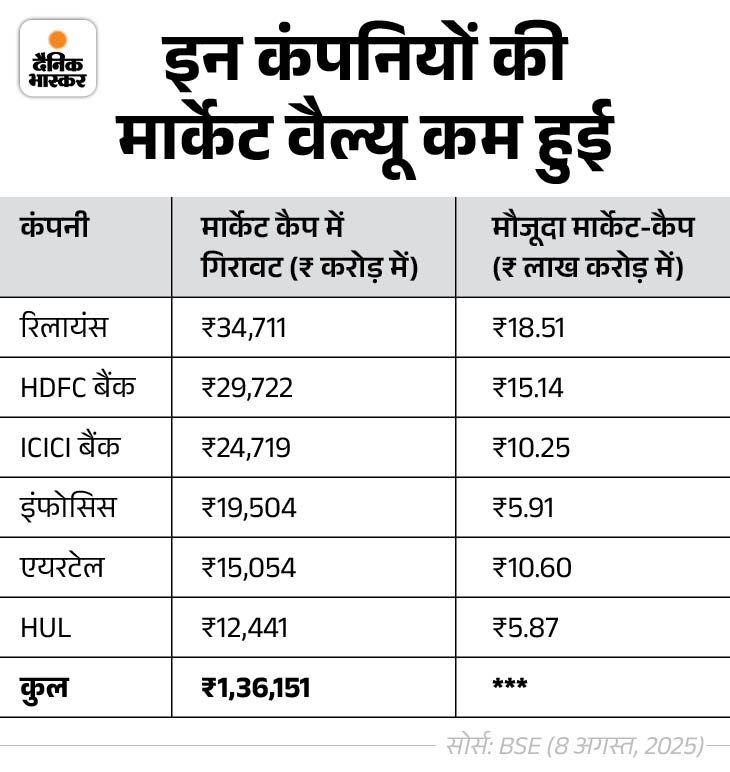

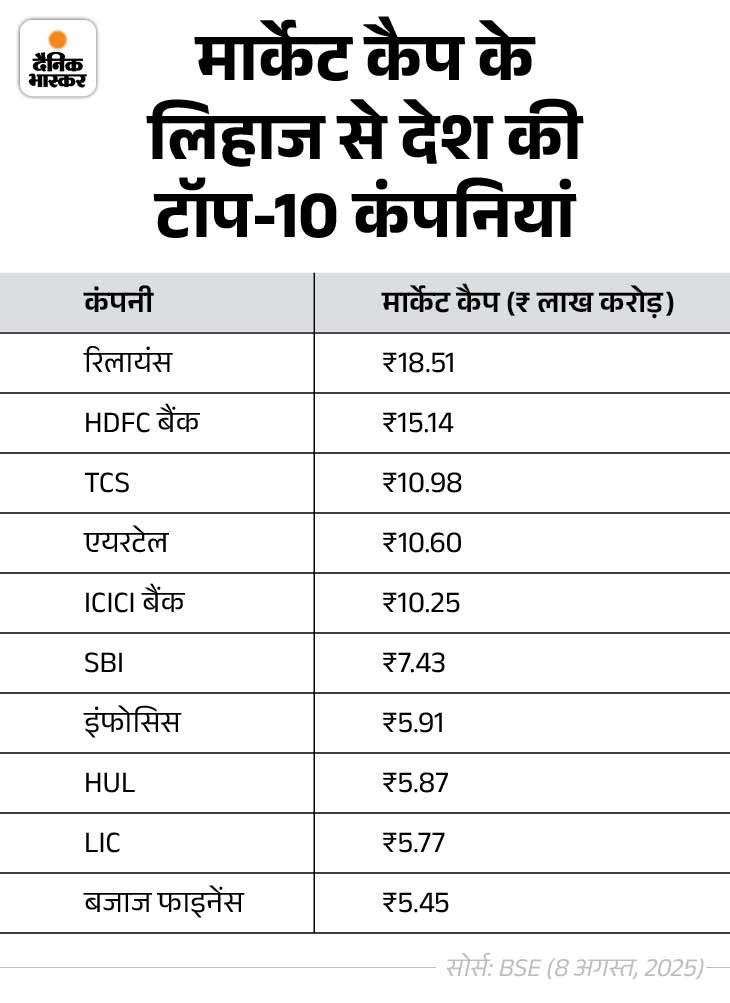

In terms of market valuation, 6 out of the top-10 companies in the country have reduced ₹ 1.36 lakh crore in this week’s business. During this period, Reliance Industries, the country’s largest company, was the top loser. Its value has been reduced by ₹ 34,711 crore to ₹ 18.51 lakh crore.

At the same time, HDFC Bank’s market cap has come down by Rs 29,722 to ₹ 15.14 lakh crore and ICICI Bank value has come down to ₹ 24,719 crore to Rs 10.25 lakh crore.

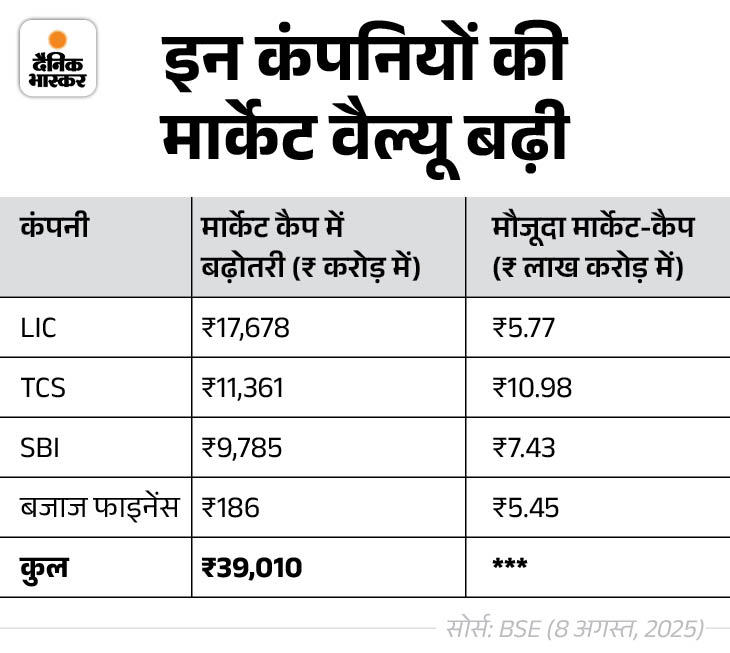

LIC’s value increased by ₹ 17,678 crore to 5.77 lakh crore

Here, Life Insurance Corporation of India LIC shares were purchased and its value has increased by Rs 17,678 crore to Rs 5.77 lakh crore. During this period, TCS’s ₹ 11,361 crore, SBI’s ₹ 9,785 crore and Bajaj Finance value has increased by ₹ 186 crore.

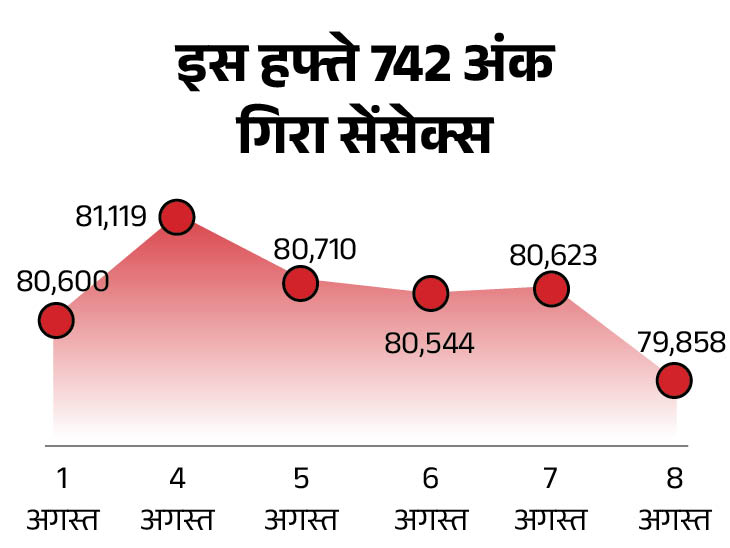

Sensex dropped 742 points this week

The Sensex declined by 742 this week after a week -long trading. The Sensex closed at 80,600 on 1 August. The last trading day of the week came at 79,858 on Friday, Friday, August 9.

The Sensex fell 765 points to close at 79,858 on Friday, August 8, the last trading day of the week. After 4 months it came below 80 thousand. Earlier on May 9, the market came to 79,454.

The Nifty also fell by 246 points, it closed at 24,350. Of the 30 shares of the Sensex, there was a rise in 5 and a decline in 25. Metal, IT, Auto and Realty sector shares declined significantly.

What is a market capitalization?

Market cap is the value of any company’s total outstanding stocks, ie all the shares that its shareholders currently have. Its calculation is done by multiplying the total number of issued shares of the company by their price.

Understand this with an example …

Suppose … People have purchased in 1 crore stock market of company ‘A’. If the price of a share is Rs 20, then the company’s market value will be Rs 1 crore x 20 or 20 crores.

The market value of companies increases due to increase in share prices or decreases. There are many other reasons for this …

1. What does the growth of market cap increase?

- Share price- Increased demand for shares in the market leads to competition, due to which prices rise.

- Strong Financial Performance: The company attracts investors in things like earnings, revenue, profits.

- Positive News or Event- Product launch, acquisition, new contract or regulatory approval increases demand for shares.

- Market Service- Bulish market trends or sector specific expectations such as IT sector estimate attracts investors.

- Issuing shares at high price: If a company issues new shares at a high price, the market cap increases without decreasing the value.

2. What does the decreasing market cap mean?

- Decline in share price- Due to lack of demand, the price of shares falls, it directly affects the market cap.

- Bad results- Investors sell shares due to decrease in earnings, losses or losses in a financial year or quarter.

- Negative News- Any negative news related to scandal, legal action, product failure or leadership reduces investment.

- Economy or market decline- The recession, increase in interest rates and below can drop market shares.

- Share buyback or delisting: If a company purchases shares back or becomes private, the number of outstanding shares decreases.

- Industry Challenge: The demand for shares decreases due to regulatory change, technological disorder or declining demand for a sector.

3. What is the impact on the company and investors on market cap fluctuations?

Effect on the company: The big market cap helps the company to raise funds from the market, take loans or to acquire other companies. At the same time, small or low market cap reduces the company’s ability to take financial decisions.

Effect on investors: Increasing market cap provides direct benefits to investors. Because the price of their shares increases. The same, the decline can cause damage, allowing investors to decide to sell shares.

Example: If the TCS market cap increases with ₹ 12.43 lakh crore, then investors’ assets will increase, and the company can get more capital for future investment. But if the market cap falls, it can be damaged.