New Delhi6 minutes ago

- Copy link

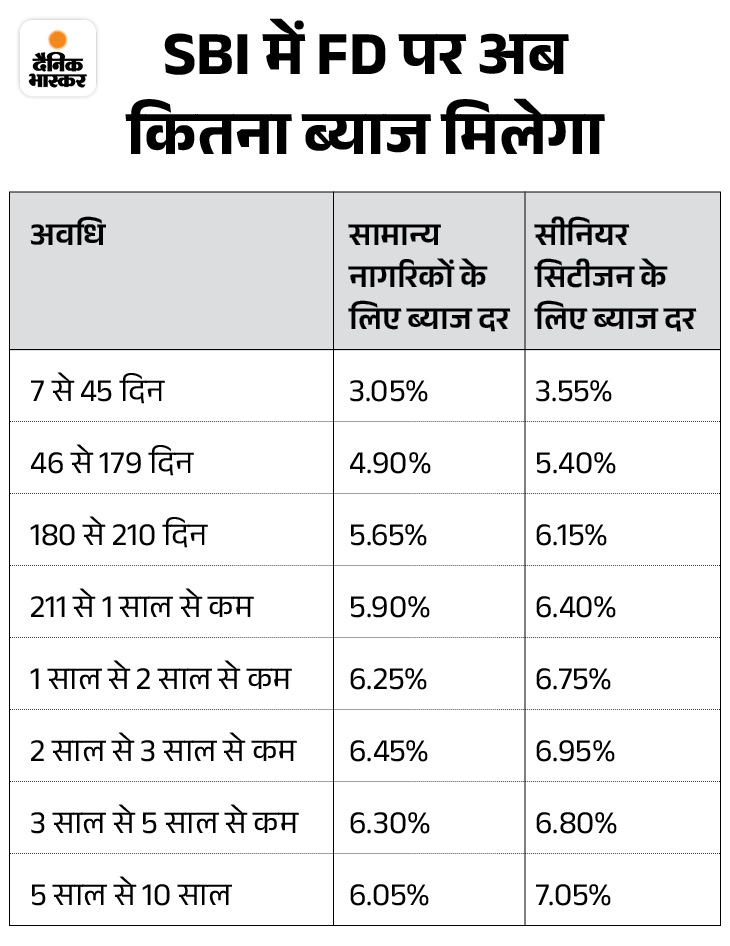

State Bank of India (SBI) has cut the interest rates of fixed deposits (FD) by up to 0.15%. On providing FD in SBI, now ordinary citizens will get interest ranging from 3.05% to 6.45%. The new interest rates have come into effect from July 15. Earlier, the bank also cut interest rates in June and May.

Special Fixed Deposit Scheme ‘Interest Rate of’ Amrit Vrishti ‘is not cut SBI has not cut the interest rates of its special fixed deposit scheme ‘Amrit Vrishti’. Now under SBI ‘Amrit Vrishti’, FD for 444 days will continue to get 6.60% annual interest. At the same time, senior citizens will get interest at 7.10% annually.

SBI ‘Wekare’ scheme also opportunity to invest SBI is also running another special term deposit (FD) scheme ‘Veekear’. In this scheme of SBI, senior citizens will get extra interest of 50 basis points on deposits (FD) of 5 years or more. Senior Citizen gets 0.50% more interest than the general public on retail term deposits of less than 5 years.

In such a situation, under the ‘Vikare Deposit’ scheme, FD of 5 years or more will get 1% more interest than ordinary citizens. According to this, senior citizens are getting 7.05% interest on providing FD for 5 years or more.

5 special things of fixed deposit

- Fixed interest rate: In FD you get an already fixed interest rate. For example, if you put it in FD for 5 years at an interest rate of Rs 1 lakh 7%, then you will get interest along with the principal when the period is over. This interest can be simple or compound.

- Flexible Tenure: The duration of FD can range from 7 days to 10 years. You can choose a period i.e. tenure according to your need. Short -term FD pays less interest, while long -term FD gets more interest.

- Security: Your money is completely safe in FD, especially if you invest in a reputed bank or NBF. In India, it gives an insurance cover to FD up to 5 lakh rupees, that is, even if the bank drowns, your money will be safe.

- Liquidity: If you need money in the middle, you can break FD ahead of time, but it may have to pay some penalty, and interest will also be less.

- Tax exemption: If you invest in 5 years tax-saving FD, then you can get a tax exemption of up to Rs 1.5 lakh under Section 80C. But remember, the interest from FD is taxable.