Mumbai4 minutes ago

- Copy link

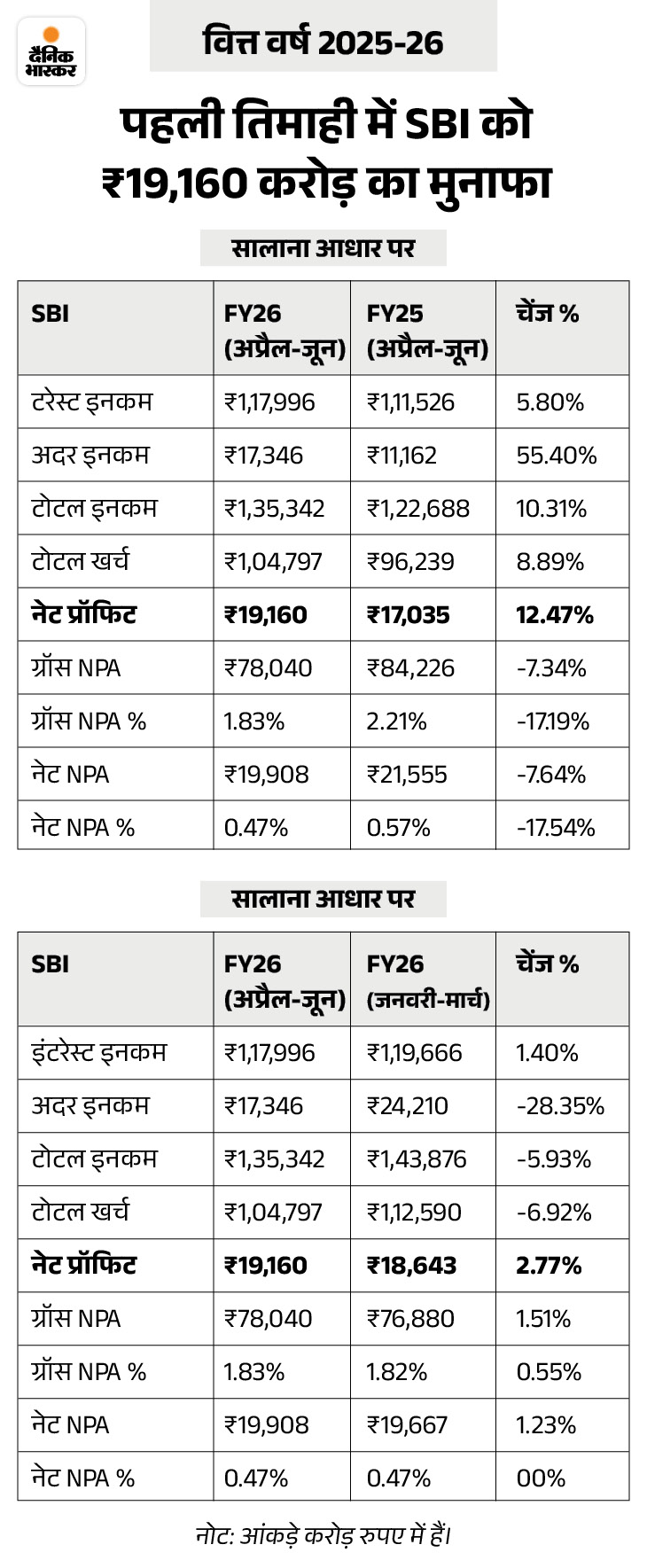

The country’s largest government lender State Bank of India (SBI) has made a profit of Rs 19,160 crore in the first quarter of FY 2025-26. It has increased 12% on an annual basis. SBI had a profit of ₹ 17,035 crore in the same quarter of last year.

State Bank’s interest income was Rs 1.18 lakh crore in the April-June (Q1Fy26) quarter. It was Rs 1.12 lakh crore in the same quarter of last year. It has increased by 6% on an annual basis.

Net NPA reduced 8% to ₹ 19,908 crore

During the first quarter (Q1fy26), the bank’s net NPA i.e. non -performing asset has reduced by 8% to Rs 19,908 crore. It was Rs 21,555 crore during April-June 2024.

What is standalone and consolidated?

Companies’ results come in two parts- Standalone and Consolidated. Standalone shows only one segment or financial performance of the unit. Whereas, the entire company reports are given in the consolidated or consolidated financial report.

The amount not received gets NPA

If the bank gives a loan or advance, if it does not recover on time, then the bank declares that amount as NPA i.e. non-performing asset. In general, in the event of not getting returns for 90 days, the bank puts the loan or advance amount in the list of NPA. This means that the bank is not getting any benefit from this amount at the moment.

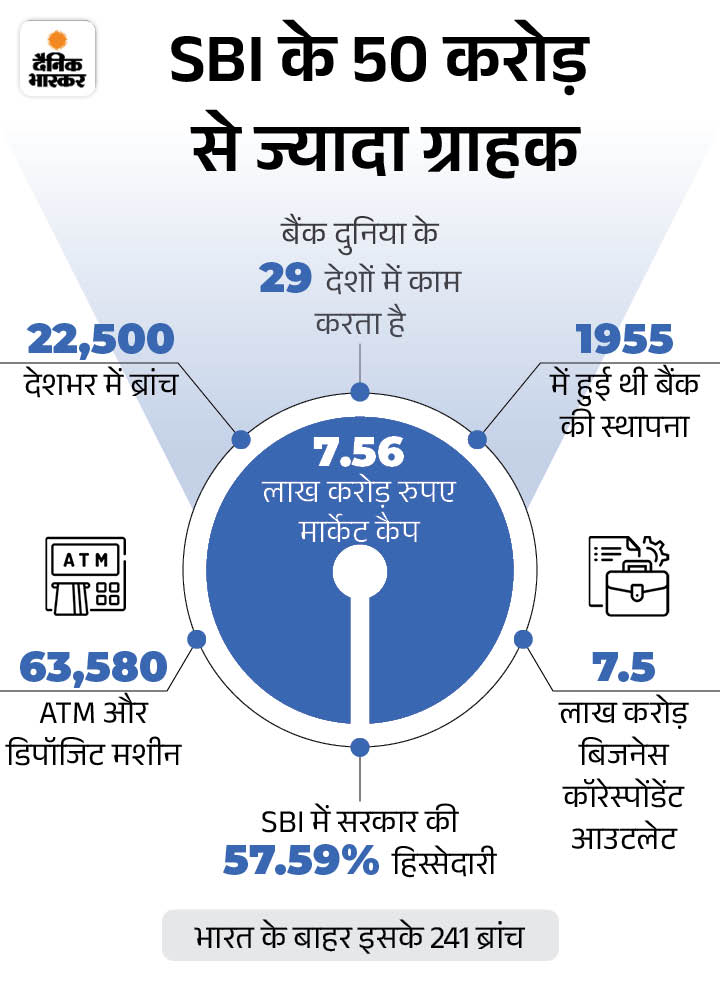

SBI is the largest government bank in the country

SBI is the largest government bank in the country. The government has 57.59% stake in SBI. It was established on 1 July 1955. The bank is headquartered in Mumbai. At the same time, the bank has more than 22,500 branches and more than 50 crore customers. The bank works in 29 countries of the world. It has 241 branches outside India.