Mumbai3 minutes ago

- Copy link

This week, RBI’s policy, trade deal to purchase and sale of foreign investors and technical factors will decide the market moves.

The date of August 8 in the week starting tomorrow is important for the stock market. According to Harshubh Shah, director of wealth analytics, a reversal pattern or strong Momentum may appear on this day. Therefore, special care should be taken on this day.

Apart from this, the RBI policy, from the US tariffs to India to the purchase and selling of foreign investors and technical factors will decide the market moves.

Let us understand what can happen in the market this week…

Support Zone: 24,535 / 24,482 / 24,458 / 24,382 / 24,331 / 24,143 / 23,875

Support means the level where the share or index falls from falling down. The price does not go down easily due to increasing shopping here. You can get a chance to shop at these levels.

Resistance Zone: 24,648 / 24,677 / 24,806 / 24,856 / 24,978 / 25,083 / 25,145

Resistance, ie, the level where the stock or index is hindered. This happens due to increasing selling. If the Nifty Registration crosses the zone, a new fast may occur.

Important dates for stock market

- August 8 is important for positive traders. Strong Momentum or reversal pattern may appear in the market. The high and low breakout of this day can work as a setup.

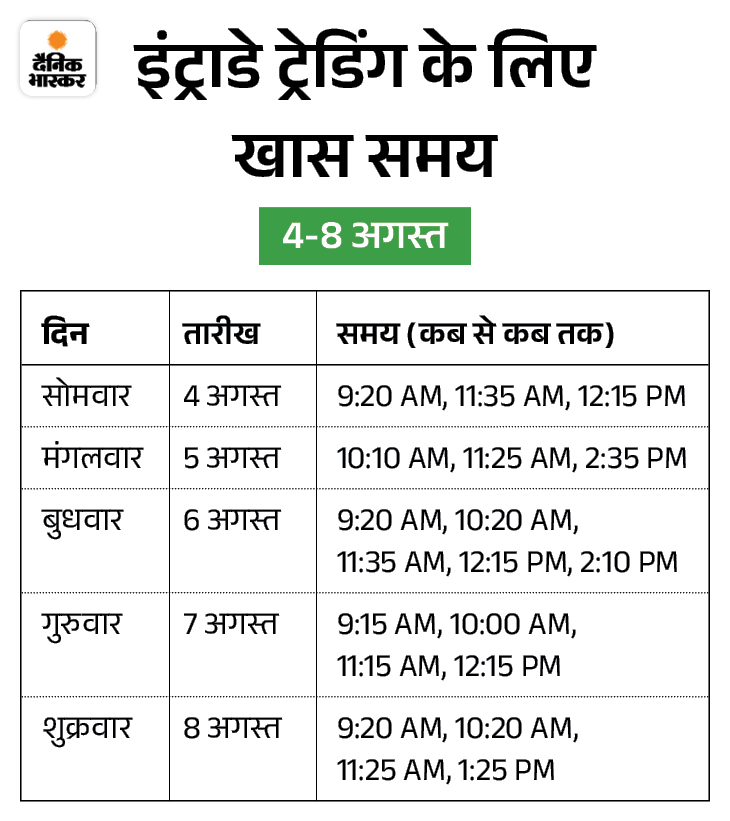

- 6 and 7 August is special for Intrade Traders. According to wealth view analytics, the time clusters mentioned on these dates may have sharp movements.

Trend reversal was shown on the date stated of 29 July

Harshubh Shah, director of wealth analytics, had expressed the possibility of Trend Reversal on July 29 in the previous report. The Nifty started a weak start around 24,600 that day, but came to reversal on the same day. After this, the market climbed to two consecutive sessions to close to 24,950. That is, a growth of 250+ points from the day of Reversal.

Support and resistance also worked accurately

- 28 July: The day and low zone of the day remained between 24,850-24,676.

- 29 July: The high was built at 24,847.15 which was very close to the 24,850 level mentioned.

- 31 July: The Nifty took support at 24,805 and jumped to 24,956.50.

- 1 August: The day of the day was 24,535, which was close to the 24,538 level mentioned.

Now 5 factors who can decide the direction of the market…

1. RBI’s policy: The Monetary Policy Committee of the Reserve Bank of India (RBI) is going to meet from August 4 to 6. It is expected that this time the interest rate may be reduced by 0.25%.

This cut may boost sectors like bank, NBFC, real estate and auto. In the RBI meeting held in June, the Monetary Policy Committee had reduced the repo rate from 0.50% to 5.50%.

RBI Governor Sanjay Malhotra will give information about the decisions of the Monetary Policy Committee on 6 August.

2. Trump’s tariff on India: US President Donald Trump has imposed 25% tariff on India. This tariff will be applicable from August 7. Negotiations are also going on between the two countries about the trade deal, but it has not been finalized yet. In such a situation, the eye of investors will be on the impact and trade deal on tariffs.

3. Foreign Investor (FIIS): Foreign institutional investors (FIIs) are continuously selling. In the last nine trading sessions, he has sold more than Rs 27,000 crore. On Thursday, Fiis sold equity worth Rs 5,588.91 crore.

Vinod Nair, the research head of Geojit Investments, said, “The market continued to swing between a scope, but the FII finally closed down due to the frequent selling of FII.”

4. Results of companies: So far more than 900 companies have declared their first quarter financial results. Next week, around 120 companies will declare their June quarter results in the Indian stock market.

Large companies like Bharti Airtel, Tata Motors, LIC, SBI, BSE, Trent, DLF, and Titan will present their first quarter -earnings results next week.

5. Technical Factors: According to Ajit Mishra, Senior Vice President (Research), Railways Broking Limited, the closure of the Nifty below 24,600 reflects the recession situation. Short term structure suggests that if there is no strong recovery, the market may fall further.

Mishra said, “Now the Nifty can get Imidiet support around 24,450. If this level breaks, the decline can be faster and the Nifty can go up to 24,180. If the market booms, 24,800 will be the first resistance and then the zone of 25,000–25,250 can become a big obstruction.”

LKP Securities Senior Technical Analyst Roopak Dey said, “The Nifty on the Daily Chart has recently broken the consolidation support of 24,600. The market mood is weak and there is a possibility of correction up to 24,400–24,450 and it is likely to be done. If it is slipped below 24,400, it can be expected; Resistance is visible at 24,600–24,650 and 24,850. “

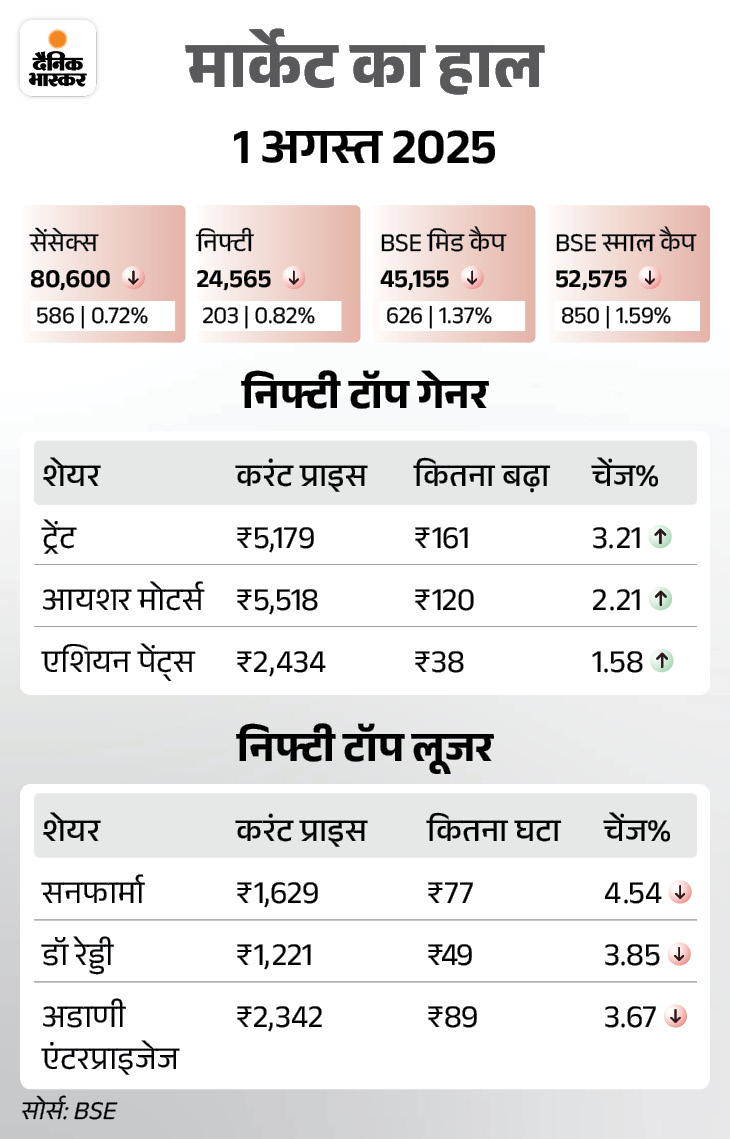

The Sensex closed down 586 on Friday

The Sensex fell 586 points to close at 80,600 on the last trading day of the week. The Nifty also declined by 203 points, it closed at 24,565 levels. Out of 30 Sensex’s 30 shares, 6 shares rose and 24 declined.