Mumbai4 minutes ago

- Copy link

Despite the weak results of the first quarter, Tata Motors shares increased by more than 3% today (Monday, August 11). At the end of business, the company’s stock rose by 3.20% to Rs 654.

In the last 1 month, the company’s stock has fallen 4% and 3.5% in six months. At the same time, the company’s stock has fallen by about 40% in a year. The company’s market cap is 2.41 lakh crore rupees.

Why the company’s shares rise

Despite the weak results, there are a ray of hope for the company on many fronts. Due to this, there has been recovery in stock. JLR’s EBIT margin 485 basis points have decreased in the first quarter. But on a quarterly basis it has been slightly better than the estimate.

Even after the weak first quarter, JLR’s EBIT margin guidance of FY 2026 remains at 5-7%. Experts say that the uncertainty of the tariff is expected to improve. At the same time, the CV market share is expected to improve 50 basis points on a quarterly basis. EV growth in FY 2026 can increase from 13% to 17%.

What should be the strategy in stock?

According to brokerage firm Jefferies, Tata Motors shares are expected to have weakness in the near future, due to which the brokerage firm has reduced its target price to Rs 550 per Rs 550 per Rs. Brokerage has predicted rising competition, tax in China, warranty costs, and pressure due to older models of JLR.

At the same time, India’s passenger vehicle segment has also spoken of decreasing market share and pressure on margin. Brokerage has also mentioned the weak demand of commercial vehicles and concerns about the acquisition of EVECO. Due to this, EPS estimates of FY 2026-28 have been cut by 8-15%.

Motilal gave ‘Neutral’ rating on stock

Motilal Oswal spoke about many challenges for JLR. Brokerage has repeated its ‘neutral’ rating on stock and targeted Rs 631 per share. On the other hand, domestic brokerage firm MK Global has given positive opinion on Tata Motors and rating it ‘BUY’ with a target of Rs 750.

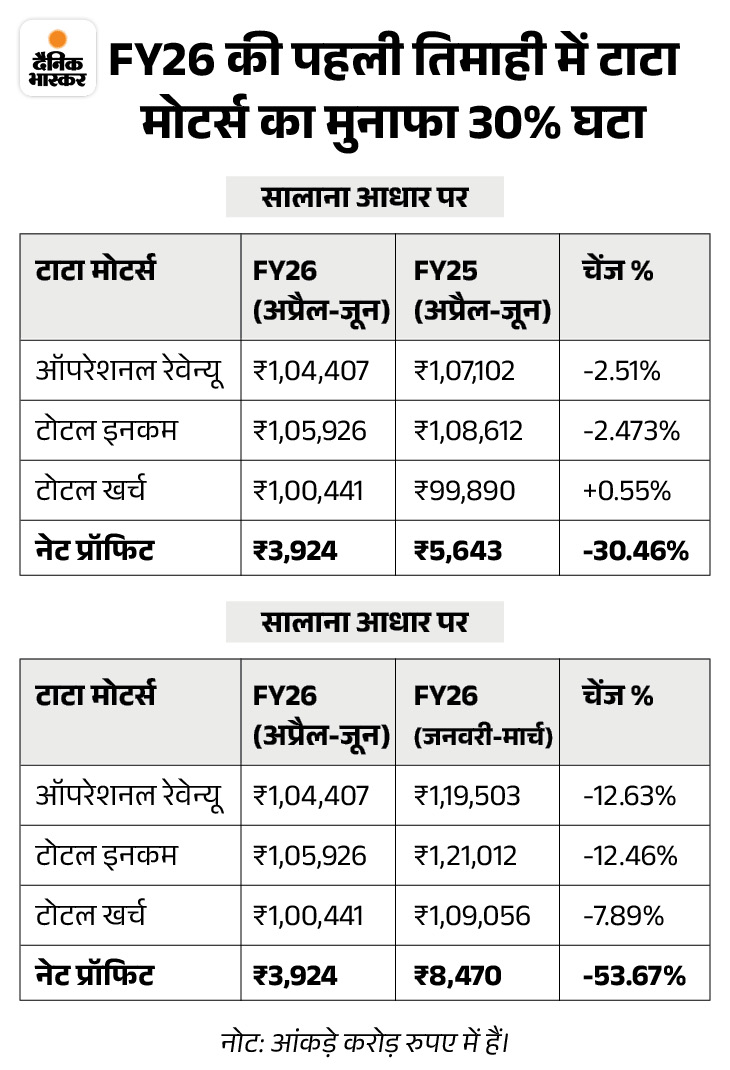

Profit declined by 30% to ₹ 3,924 crore

Automobile company Tata Motors has received a net profit of Rs 3,924 crore in the first quarter of FY 2025-26. It has been 30% less on an annual basis. The company’s profit was Rs 5,643 crore in the same quarter of a year ago.

The company’s revenue was Rs 1.04 lakh crore due to the operation in the April-June quarter. Tata Motors generated a revenue of Rs 1.07 lakh crore in the same quarter of a year ago. It has decreased by 2.51% on an annual basis.

Tata Motors Total Income Decreased by 2.47%

Tata Motors total income declined by 2.47% to Rs 1.06 lakh crore in the first quarter. The company’s total income was Rs 1.09 lakh crore in the same quarter of last year.